Tax Documents

Cross-Border Taxation

Understanding W-2 and 1099 for Independent Contractors

This file provides essential information on the differences between W-2 and 1099 forms, detailing tax responsibilities and contractor classifications. It outlines the IRS criteria for determining employment status and offers guidance on completing these forms. Navigate through concise instructions and important considerations for independent contractors and employers.

Agricultural Property Tax

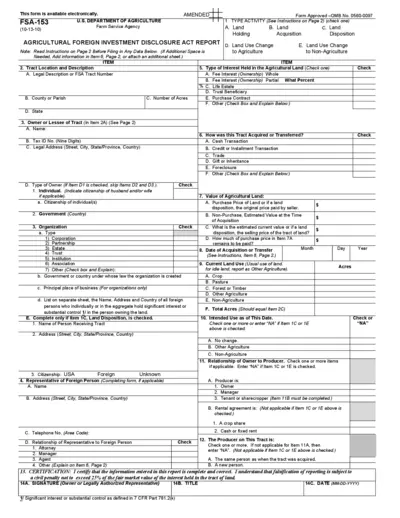

Agricultural Foreign Investment Disclosure Form

This file contains guidelines and instructions for the Agricultural Foreign Investment Disclosure Act Report. It is essential for individuals and organizations engaged in agricultural land transactions. Complete the form accurately to avoid penalties.

Cross-Border Taxation

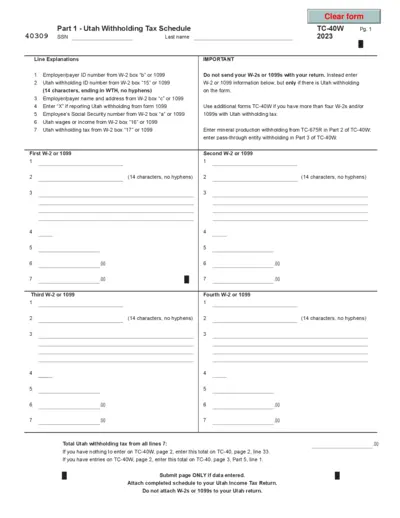

Utah Withholding Tax Schedule and Instructions

This file contains the Utah Withholding Tax Schedule for reporting income and tax withheld. It provides detailed instructions on how to complete the form accurately. Essential for tax filing in Utah, it includes guidelines for employees and employers alike.

Cross-Border Taxation

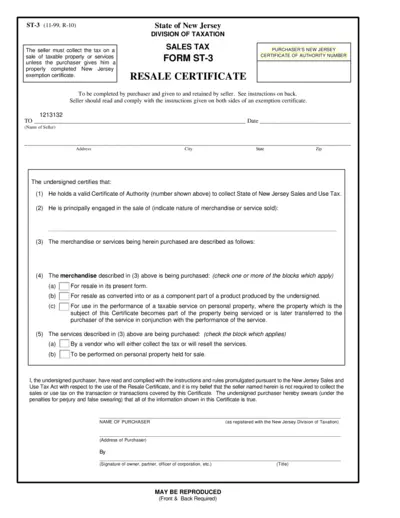

New Jersey Sales Tax Resale Certificate ST-3

The New Jersey Sales Tax Resale Certificate ST-3 is essential for sellers who need to collect sales tax. This form allows purchasers to claim tax exemptions for resale items. Proper completion ensures compliance with New Jersey tax regulations.

Cross-Border Taxation

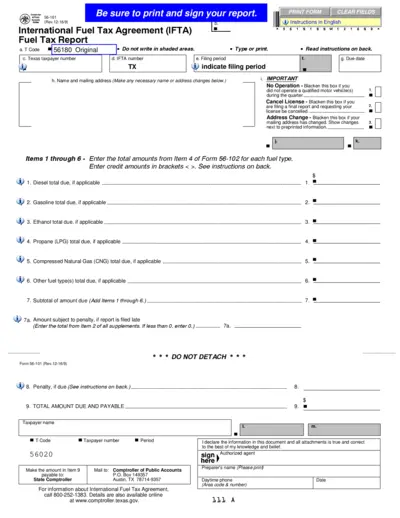

International Fuel Tax Agreement Fuel Tax Report

The International Fuel Tax Agreement (IFTA) Fuel Tax Report (Form 56-101) is essential for individuals and businesses operating qualified motor vehicles. It summarizes total fuel tax owed for the filing period and ensures compliance with tax regulations. This form facilitates the accurate reporting of fuel consumption and tax liabilities.

Cross-Border Taxation

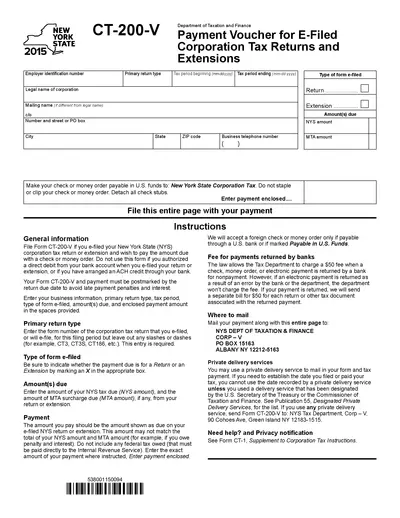

NY State Corporation Tax Payment Voucher 2015

The CT-200-V form is a payment voucher for e-filed New York State corporation tax returns and extensions. It is used to submit payments through checks or money orders. Ensure timely submission to avoid penalties.

Cross-Border Taxation

User Manual for Registration of Non-Resident E-Service Providers

This user manual is a comprehensive guide for registering Non-Resident Electronic Service providers with the Tanzania Revenue Authority. It details processes, requirements, and provides useful insights for both individuals and entities. This document aims to streamline the registration process and ensure compliance with tax regulations.

Tax Residency

Internal Medicine Residency Program at Mount Sinai

This file provides comprehensive details about the Internal Medicine Residency Program at Mount Sinai Beth Israel. It offers valuable insights into the program structure, application process, and contact information for prospective residents. Ideal for applicants looking to join a prestigious residency program in New York.

Cross-Border Taxation

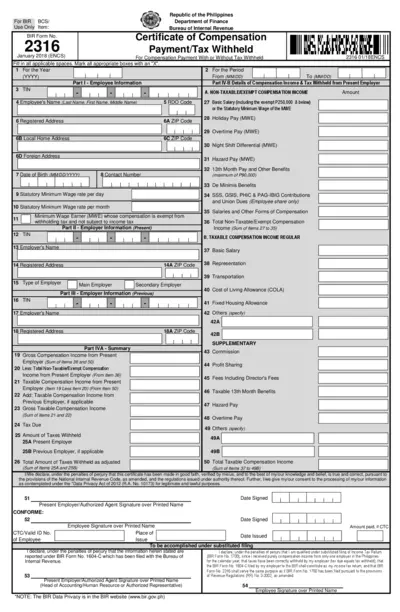

Certificate of Compensation Payment/Tax Withheld

This file is the BIR Form No. 2316, which serves as the Certificate of Compensation Payment and Tax Withheld. It's essential for employees to report their compensation and taxes accurately. This form should be filled out by both employees and employers for compliance with Philippine tax regulations.

Cross-Border Taxation

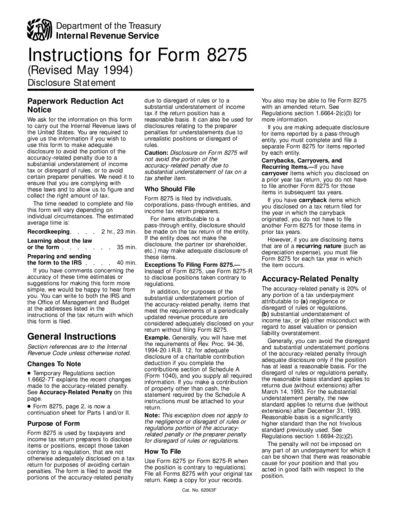

Instructions for Form 8275 Disclosure Statement

Form 8275 is used to disclose tax positions to avoid penalties. It allows taxpayers to comply with IRS rules effectively. Use this form to ensure proper disclosure and minimize risks of penalties.

Cross-Border Taxation

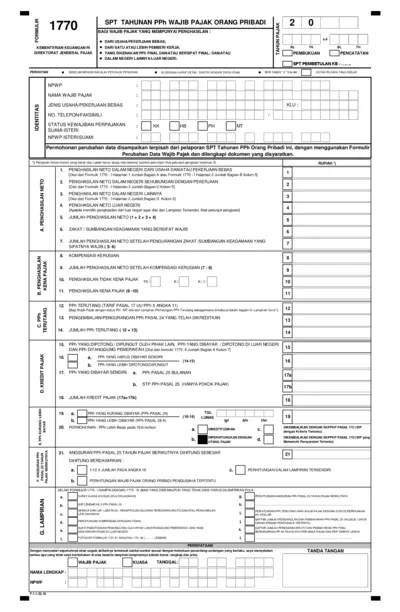

SPT Tahunan PPh Wajib Pajak Orang Pribadi Formulir

This file provides the annual tax return form for individual taxpayers in Indonesia. It includes instructions for reporting income from employment and business activities. Prepare your financial details properly to ensure accurate tax calculations.

Agricultural Property Tax

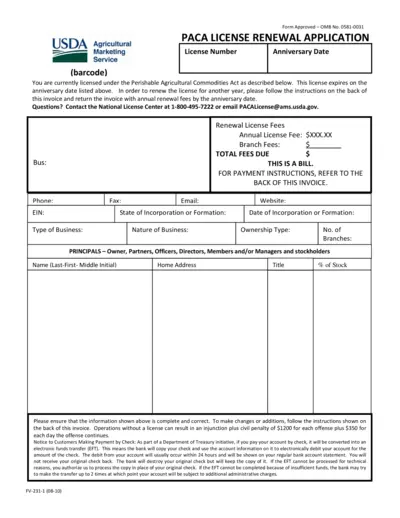

PACA License Renewal Application Instructions

This document provides details on renewing your PACA license under the Perishable Agricultural Commodities Act. It includes essential information and instructions to follow for successful application. Ensure to complete the form accurately to avoid delays.