Tax Documents

Cross-Border Taxation

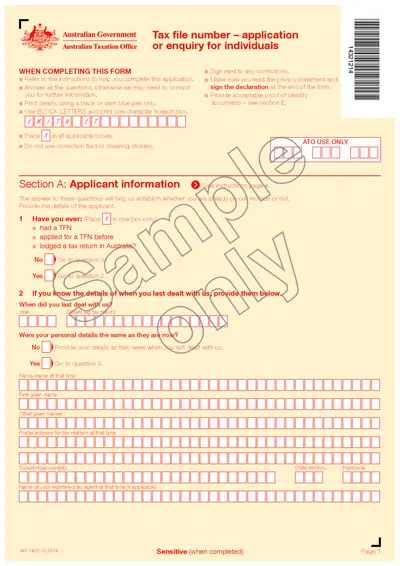

Australian Tax File Number Application and Instructions

This document provides the application form for obtaining a Tax File Number in Australia. It includes essential instructions to guide you through the completion process. Ensure all information is filled out correctly to avoid delays.

Cross-Border Taxation

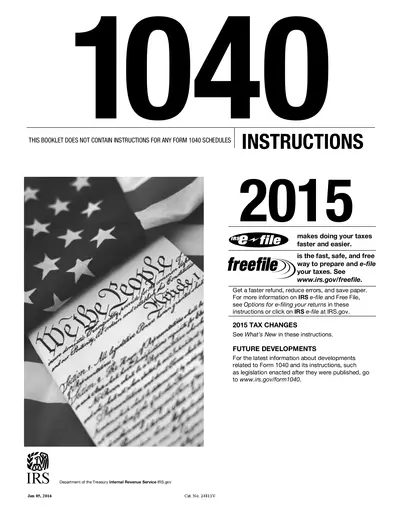

Guide to Filing Form 1040 and Tax Instructions

This file provides essential instructions on completing Form 1040 for your tax filings. It details requirement, steps, and resources needed for successful submissions. Tailored for both individuals and businesses looking to simplify their filing process.

Cross-Border Taxation

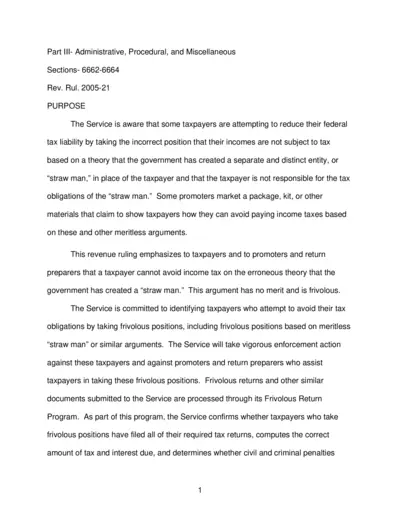

Understanding the Straw Man Theory and Tax Obligations

This file provides essential information about the 'straw man' theory and its relationship with federal tax obligations. It outlines the consequences for taxpayers who attempt to avoid taxes using erroneous claims. It serves as a guide for taxpayers to understand their responsibilities regarding tax submissions.

Sales Tax

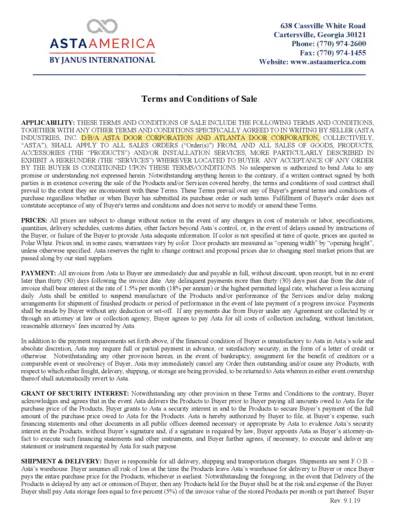

AstaAmerica Terms and Conditions of Sale

This document outlines the terms and conditions of sale for Asta America products and services. It provides important information regarding pricing, payment, and warranties. Businesses and individuals should refer to this document for a comprehensive understanding of their purchasing obligations.

Cross-Border Taxation

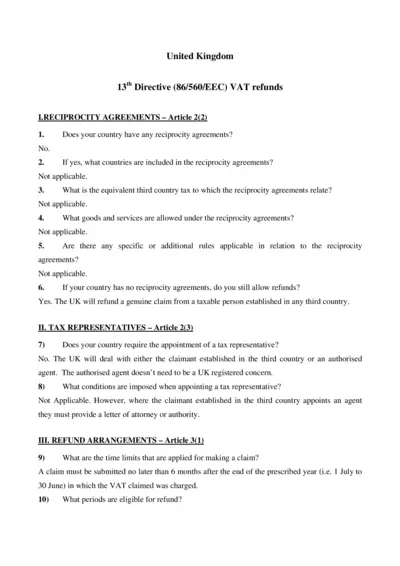

UK VAT Refunds Guide under the 13th Directive

This file provides comprehensive details regarding VAT refunds in the UK under the 13th Directive. It outlines essential instructions and requirements for potential claimants. Users will find information about eligibility, requirements, and the refund process.

Cross-Border Taxation

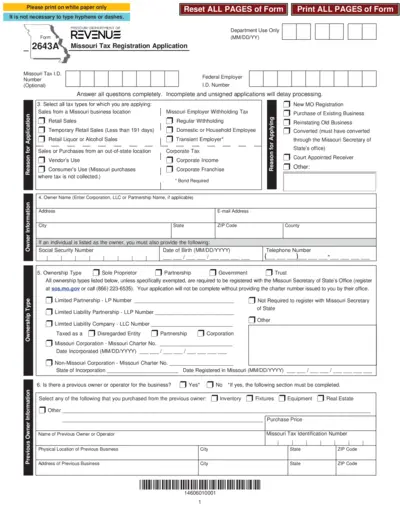

Missouri Tax Registration Application Form 2643A

The Missouri Tax Registration Application Form 2643A allows businesses to register for various tax types in Missouri. It outlines the required information and instructions for completing the form. Proper registration ensures compliance with Missouri tax laws and timely processing of applications.

Tax Returns

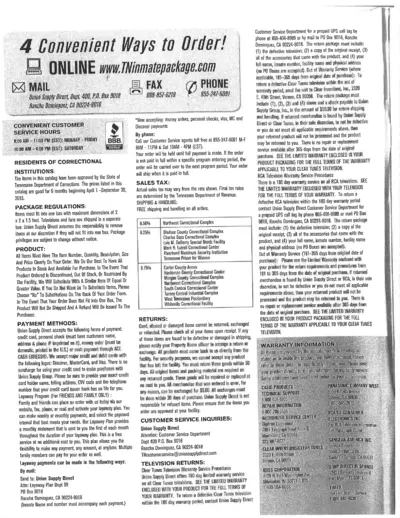

Instructions for Using Clear Tunes and RCA Returns

This document outlines the return procedures for Clear Tunes and RCA televisions. It specifies the necessary items for returning defective products. Follow these instructions carefully to ensure a smooth return process.

Cross-Border Taxation

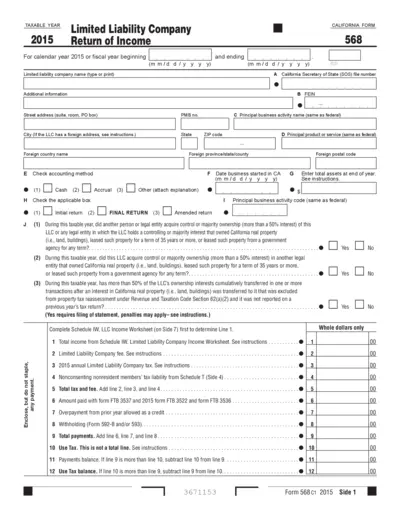

California Form 568 Limited Liability Company Tax Return

This form is essential for Limited Liability Companies in California to report their income and pay taxes. It includes various fields to capture business information and financial details. Ensure accurate completion to avoid penalties and ensure compliance.

Cross-Border Taxation

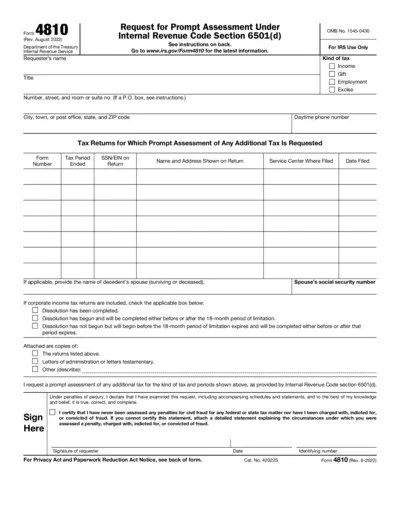

Request for Prompt Tax Assessment Form 4810

Form 4810 enables users to request a prompt assessment of tax under IRS regulations. It is essential for individuals and entities needing quick tax assessments. Ensure all relevant documentation is provided with the form to expedite processing.

Cross-Border Taxation

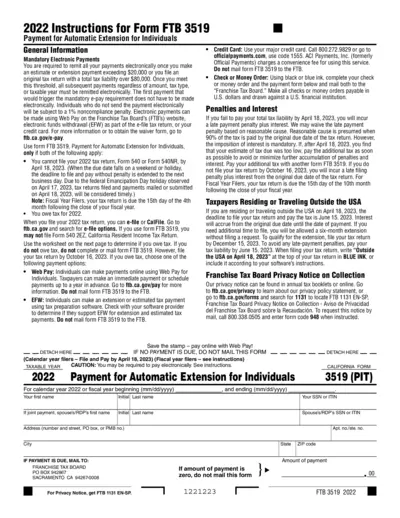

Form FTB 3519 Automatic Extension Payment Instructions

This document provides instructions for individuals filing Form FTB 3519 for automatic tax extension payments. It outlines who needs to use the form, how to fill it out, and payment options. Essential for those unable to file their 2022 tax returns by the deadline.

Cross-Border Taxation

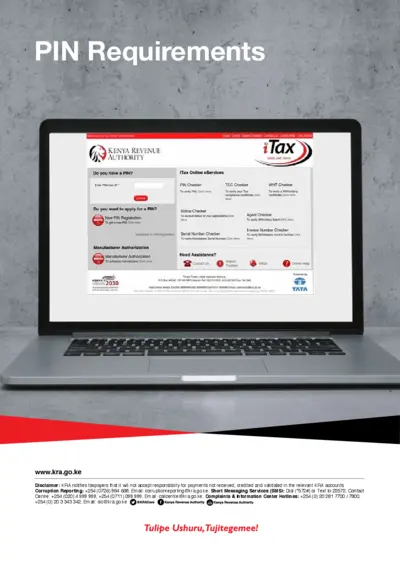

ITas Crèce Service Area PIN Requirements Kenya

This document provides detailed information about the Personal Identification Number (PIN) registration process in Kenya. It includes requirements, how to apply, and FAQs related to the iTax system. Perfect for individuals and businesses needing to comply with KRA regulations.

Cross-Border Taxation

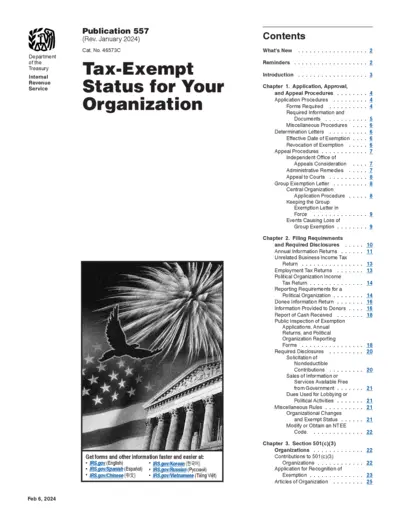

Tax-Exempt Status for Your Organization

This publication provides essential information about applying for tax-exempt status under the Internal Revenue Code. It outlines application procedures, filing requirements, and details pertinent to various exempt organizations. Use this guide to navigate the complexities of tax exemption applications effectively.