Tax Documents

Cross-Border Taxation

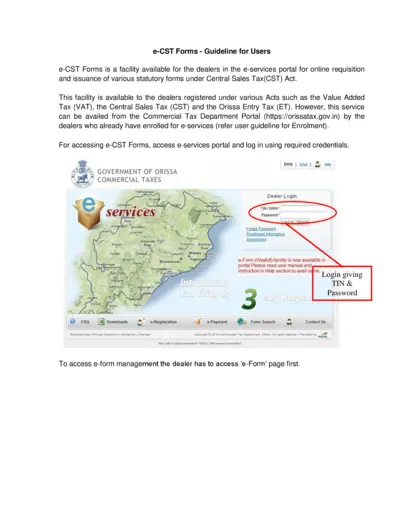

e-CST Forms Guidelines for Dealers

The e-CST Forms provide a streamlined online process for dealers to requisition and issue statutory forms under the CST Act. This guideline assists users in navigating the e-services portal for efficient form management. Learn how to fill out and submit the necessary forms easily.

Tax Returns

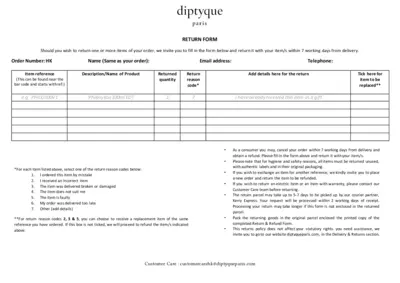

Diptyque Paris Return Form Instructions

This document provides detailed instructions for returning items purchased from Diptyque Paris. It includes a return form that must be filled, along with guidelines on how to submit it. Ensure you adhere to the return policy to facilitate a smooth process.

Cross-Border Taxation

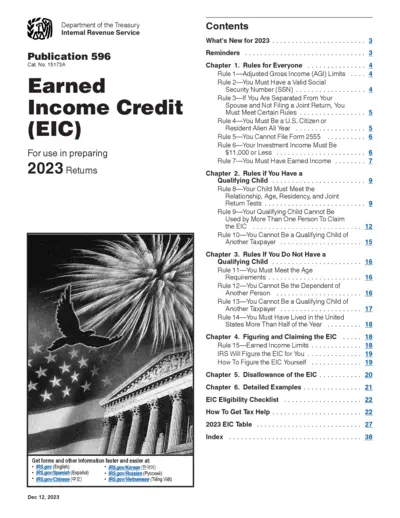

IRS 2023 Publication 596 Earned Income Credit Guidelines

This publication provides comprehensive guidance on the Earned Income Credit (EIC) for the tax year 2023. It outlines eligibility requirements, tax benefits, and instructions for claiming the EIC. Suitable for taxpayers seeking to maximize their tax benefits and ensure compliance with IRS rules.

Cross-Border Taxation

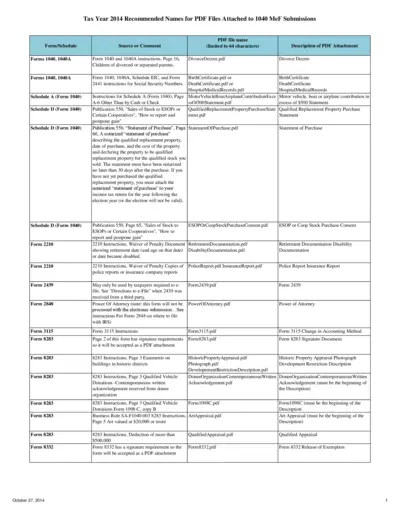

Tax Year 2014 PDF File Instructions for 1040

This file contains recommended names for PDF files attached to 1040 MeF submissions. It includes vital information for tax year 2014 requirements. Users can learn how to effectively fill out necessary forms and schedules for their submissions.

Cross-Border Taxation

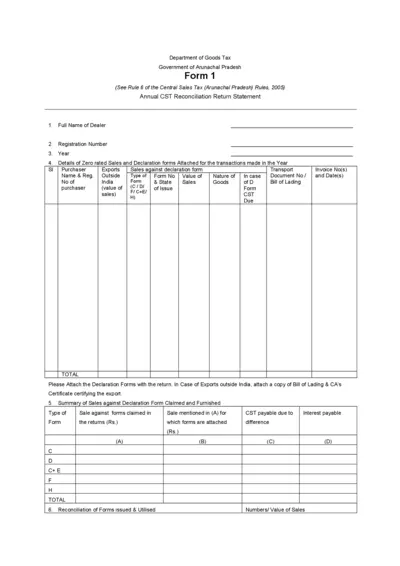

Arunachal Pradesh CST Reconciliation Return 2005

This file is the Annual CST Reconciliation Return Statement for dealers in Arunachal Pradesh. It includes detailed instructions on filling out the form accurately. Necessary for compliance with the Central Sales Tax rules.

Cross-Border Taxation

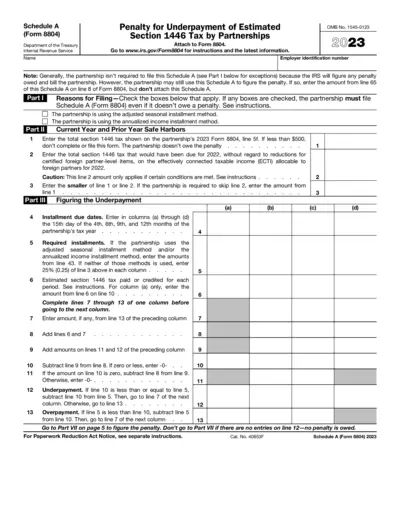

IRS Schedule A 2023 Guidance for Form 8804 Penalties

This file provides essential instructions for completing Schedule A (Form 8804). It covers penalty assessments for underpayment of estimated tax by partnerships. Perfect for partnerships needing clarity on tax obligations and calculations.

Cross-Border Taxation

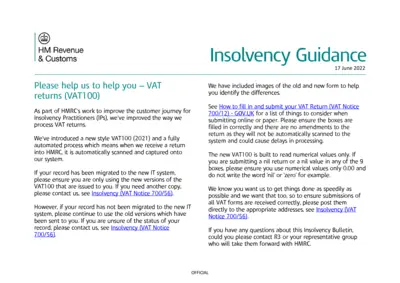

HMRC VAT Return Guidance for Insolvency Practitioners

This document provides essential guidance on completing VAT returns for insolvency practitioners. It includes updated forms and instructions on submitting your VAT100 returns effectively. Ensure compliance and swift processing by following these guidelines.

Cross-Border Taxation

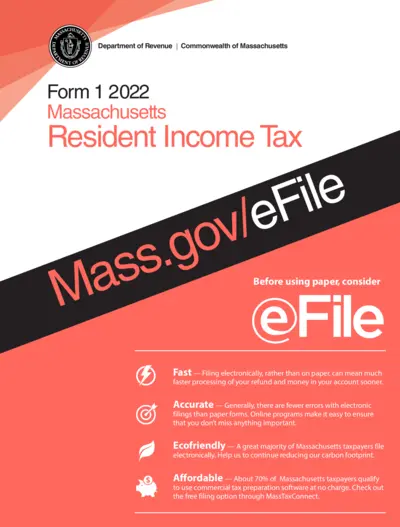

Massachusetts Resident Income Tax Form 1 Instructions 2022

This document provides detailed instructions for filling out the Massachusetts Resident Income Tax Form 1 for the year 2022. It includes important dates, tax rates, and electronic filing options. Perfect resource for Massachusetts taxpayers seeking clear guidance.

Cross-Border Taxation

General Instructions for Forms W-2 and W-3 2024

This file provides essential guidelines for filling out and submitting IRS Forms W-2 and W-3 for 2024. It includes information on requirements, electronic filing, and special situations. Business owners and payroll administrators will find detailed instructions to comply with tax regulations.

Cross-Border Taxation

User Manual for e-Application CST Declaration Forms

This User Manual provides comprehensive guidance for users on the e-Application for CST Declaration Forms. Get step-by-step instructions to navigate effectively through the system. Ideal for both individuals and businesses seeking clarity on the CST declaration process.

Cross-Border Taxation

Authorization of Accountant in VAT Filing

This file is a formal authorization document required for a registered dealer in Karnataka who wishes to allow their accountant or tax practitioner to represent them before the Value Added Tax Authority. It is essential for ensuring compliance with the Karnataka Value Added Tax Act, 2003. Proper submission of this form can help streamline tax assessment processes.

Cross-Border Taxation

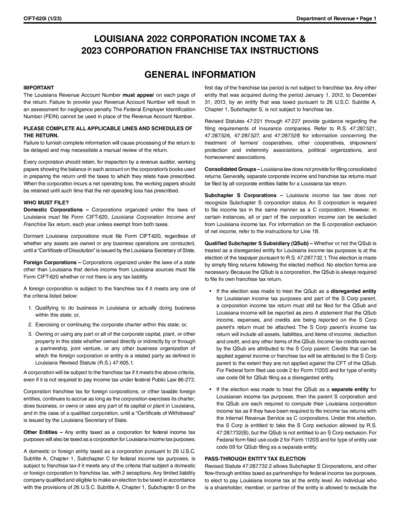

Louisiana Corporation Income and Franchise Tax Guide

This file contains detailed instructions for filing Louisiana Corporation Income and Franchise Tax returns. It provides information on who must file, important deadlines, and guidelines for completion. Business entities in Louisiana should reference this document for accurate compliance.