Tax Documents

Cross-Border Taxation

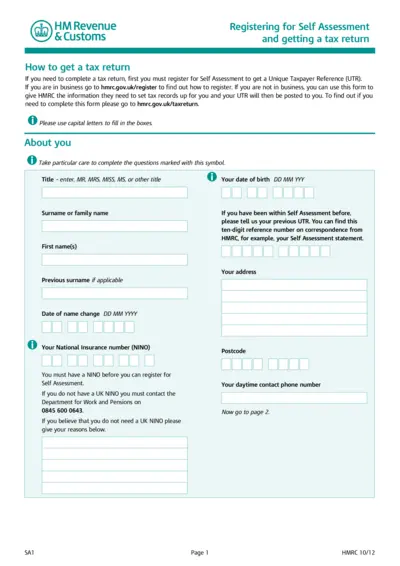

Registering for Self Assessment and Tax Returns

This file contains essential information on registering for Self Assessment in the UK, including the steps to acquire a Unique Taxpayer Reference (UTR). It guides users through filling out a tax return form accurately and adhering to necessary tax regulations. Ideal for both individuals and businesses, the document simplifies tax obligations and ensures compliance with HMRC requirements.

Agricultural Property Tax

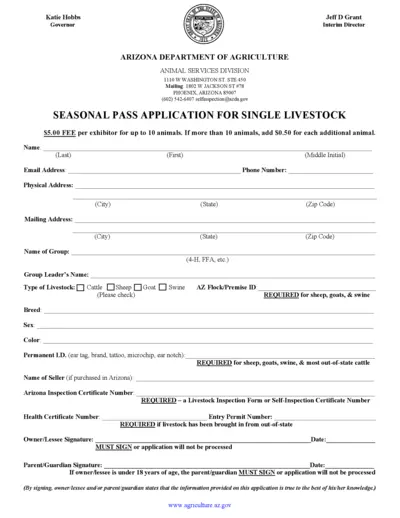

Seasonal Pass Application for Livestock in Arizona

This file contains the Seasonal Pass Application for single livestock for exhibitors in Arizona. It includes detailed information about required fees, livestock types, and necessary documentation. Ideal for individuals and groups wanting to exhibit livestock in Arizona.

Cross-Border Taxation

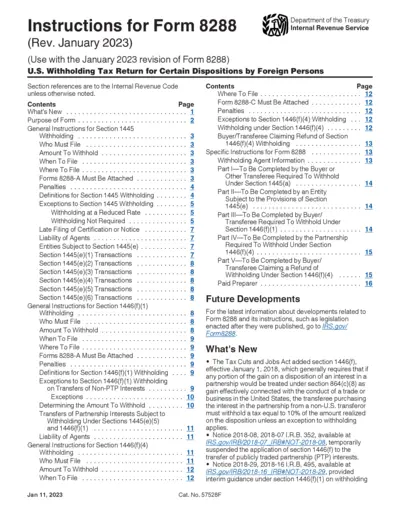

Instructions for Form 8288 U.S. Withholding Tax Return

This file provides essential guidance on Form 8288 for foreign persons involved in certain disposals. It outlines instructions on filling out the form, filing requirements, and withholding obligations. Ideal for taxpayers and accountants seeking compliance with U.S. tax withholding regulations.

Sales Tax

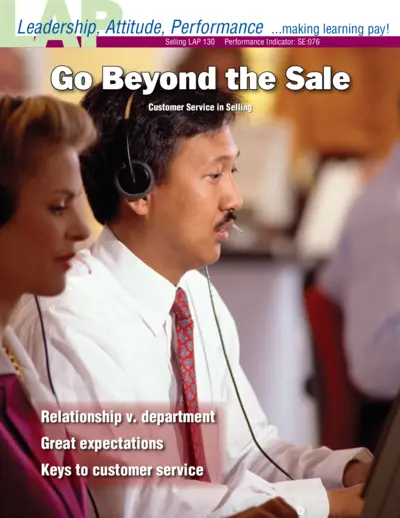

Leadership in Customer Service and Sales Training

This file provides detailed insights into how customer service impacts sales relationships. It includes examples, objectives, and valuable tips for improving customer service. Ideal for sales professionals seeking to enhance their skills.

Cross-Border Taxation

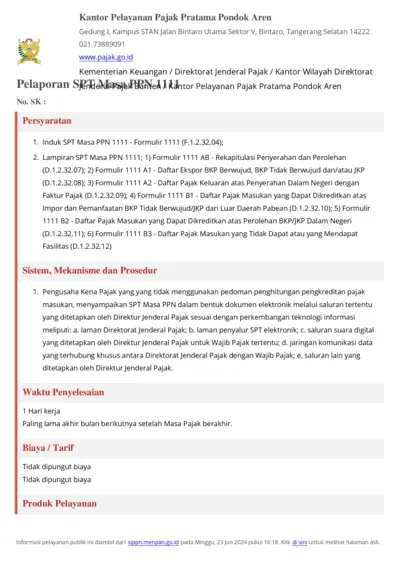

Kantor Pelayanan Pajak Pratama Pondok Aren Instructions

This file provides essential details and instructions for filing SPT Masa PPN at Kantor Pelayanan Pajak Pratama Pondok Aren. It includes necessary forms, requirements, and submission methods. Perfect for individuals and businesses needing to comply with tax regulations in Indonesia.

Cross-Border Taxation

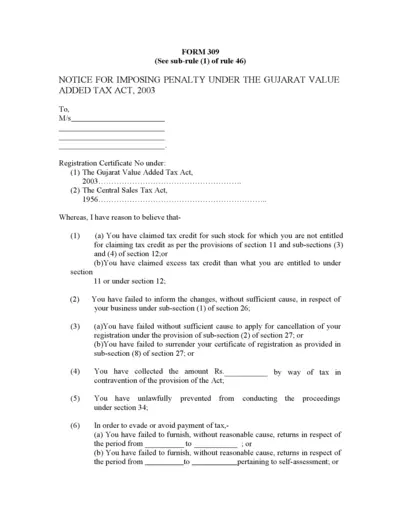

Penalty Notice Under Gujarat VAT Act 2003

This file contains a formal penalty notice under the Gujarat Value Added Tax Act, 2003. It outlines various reasons for imposing a penalty related to tax credits and compliance. Users must understand their obligations and rights regarding this notice.

Cross-Border Taxation

Taxation of Short-Term Rental Units in TN 2023

This file provides comprehensive guidelines on the taxation of short-term rental units in Tennessee. It covers various tax types including Sales and Use Tax, Local Occupancy Taxes, and Business Tax. A must-read for property owners and managers involved in short-term rentals.

Cross-Border Taxation

IRS e-Services e-file Application Process

This file provides essential details for corporations required to electronically file with the IRS. It includes instructions on the e-Services application process and related resources. Perfect for tax professionals and corporate taxpayers.

Cross-Border Taxation

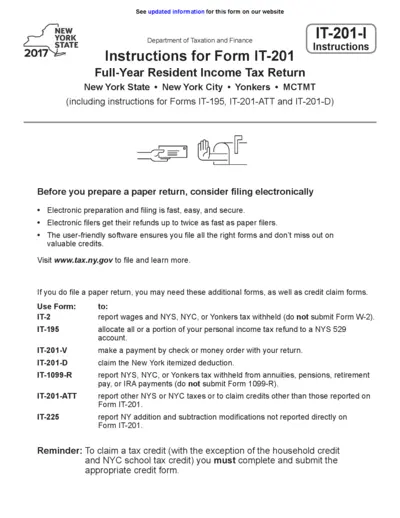

NY State IT-201-I Full-Year Resident Income Tax

This document provides detailed instructions for the New York State IT-201 Full-Year Resident Income Tax Form. It is essential for taxpayers to understand their filing requirements and available credits. Follow the guidelines provided to ensure accurate and timely submission.

Cross-Border Taxation

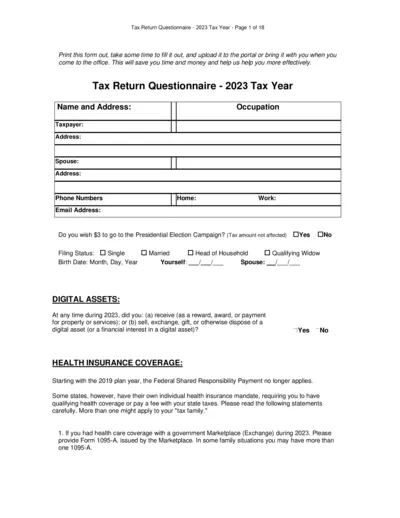

Tax Return Questionnaire 2023 - Complete Guide

This file contains the Tax Return Questionnaire for the 2023 tax year. It includes important instructions and fields necessary for accurate tax filing. Use this questionnaire to ensure you have all your information ready for your tax return.

Cross-Border Taxation

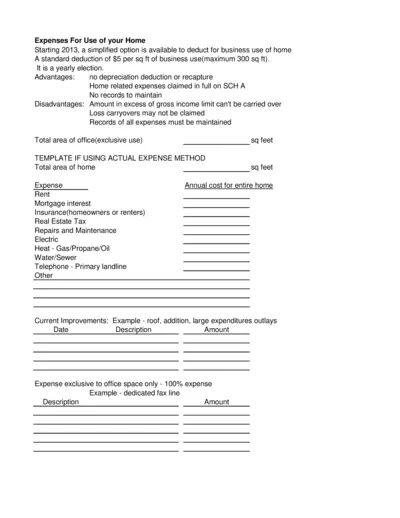

Home Business Expenses Deduction Guide 2013

This file provides information about deductions for business use of home starting in 2013. It outlines simplified and actual expense methods. Users will find a breakdown of required records and instructions for filling out the form.

Cross-Border Taxation

Malaysia LHDN EA & EC Guide Notes 2021

This file provides comprehensive guide notes for completing Forms C.P.8A (EA) and C.P.8C (EC) in Malaysia. It includes details regarding income types, allowances, and relevant tax information. Essential for both employers and employees to ensure correct tax submissions.