Tax Documents

Cross-Border Taxation

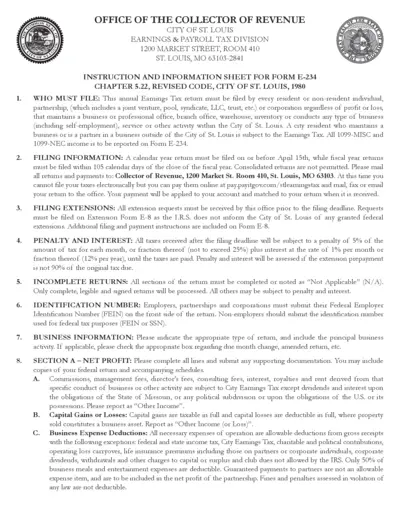

St. Louis Earnings Tax Return Instructions

This document provides essential guidance on filing the St. Louis Earnings Tax Return Form E-234. It includes instructions for various business types and details on penalties for late submissions. Ensure compliance with local tax regulations by following the guidelines outlined in this form.

Cross-Border Taxation

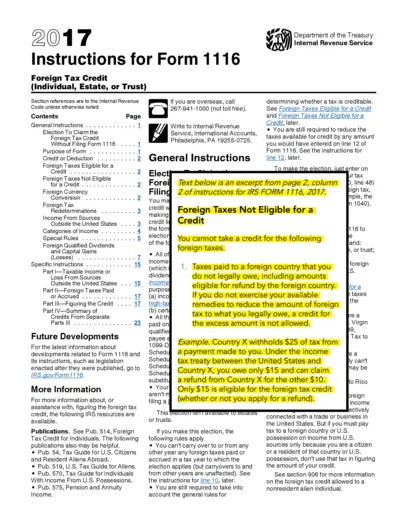

Instructions for Form 1116 Foreign Tax Credit

This file provides detailed instructions for filling out Form 1116, which is used to claim a foreign tax credit. It explains eligibility, deductions, and how to correctly report foreign taxes paid. Users will find guidance on specific line items and necessary qualifications to ensure compliance.

Cross-Border Taxation

Homestead Credit Refund and Renter's Property Tax Refund Instructions

This document provides guidance for homeowners and renters in Minnesota regarding the Homestead Credit Refund and Renter's Property Tax Refund. It includes eligibility criteria, filing instructions, and important dates for refunds. Use this resource for accurate filing and timely refunds.

Cross-Border Taxation

Personal Property Tax Exemption Information 2024

This file provides essential details about the Personal Property Tax Exemption for the 2024 tax year in Michigan. It outlines crucial forms and deadlines for businesses to ensure they receive the appropriate tax exemptions. Users should carefully review the instructions to maximize their benefits.

Cross-Border Taxation

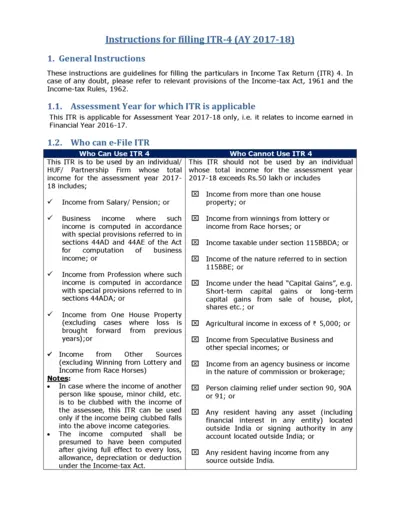

ITR-4 Filing Instructions for AY 2017-18

This document provides detailed instructions for filling out the Income Tax Return (ITR) 4 form for the assessment year 2017-18. It includes guidelines on eligibility, filing methods, and obligations. Users can learn how to accurately complete their returns and submit them to the Income Tax Department.

Cross-Border Taxation

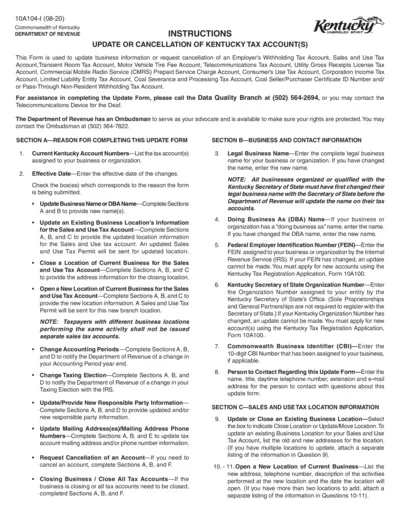

Kentucky Tax Account Update and Cancellation Form

This form enables businesses to update their tax account information or request cancellation. It covers various tax types including sales, use, and withholding taxes. Employers needing to inform the Department of Revenue about changes can seamlessly use this form.

Cross-Border Taxation

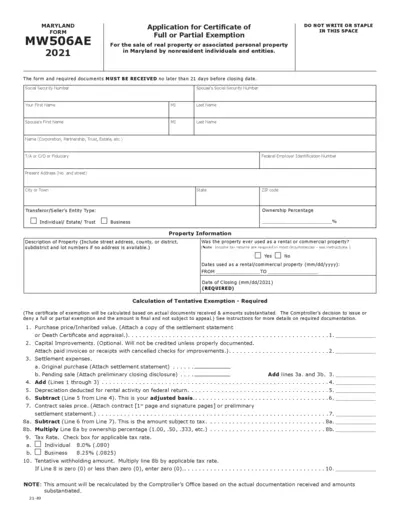

2021 MW506AE Certificate of Exemption Application

The 2021 MW506AE is vital for nonresident individuals and entities applying for a Certificate of Full or Partial Exemption in Maryland. This form facilitates the exemption from withholding requirements on real property sales. Completing this form promptly ensures compliance and expedites the exemption process.

Cross-Border Taxation

Reporting COVID-19 Federal Tax Benefits on Form 941

This document provides guidelines for reporting COVID-19 federal tax benefits utilizing Form 941. It covers important tax credits including the CARES Act employee retention credit and paid leave credits. Employers will find necessary instructions on the proper application of these tax provisions.

Cross-Border Taxation

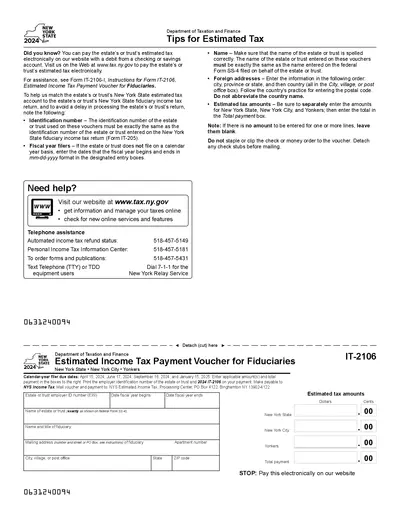

New York State 2024 Estimated Tax Payment Guide

This file provides essential tips for estimated tax payment for estates or trusts in New York State for the year 2024. It includes instructions on filling out the necessary forms and details on submission. For assistance, users can refer to the provided links and contact numbers.

Cross-Border Taxation

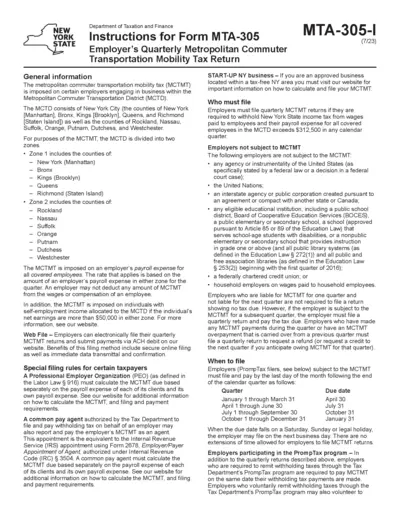

Instructions for Form MTA-305: Tax Return

This document provides detailed instructions for filing Form MTA-305, the Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return. It outlines the tax obligations for employers in the Metropolitan Commuter Transportation District and describes how to accurately report payroll expenses. Perfect for New York employers who need guidance on metropolitan commuter tax compliance.

Cross-Border Taxation

Form DTF-716 Instructions for Cigarette Dealers

This document provides essential instructions for completing Form DTF-716, necessary for registering retail dealers and vending machines for the sale of cigarettes and tobacco products in New York. This form is critical for new applicants as well as existing dealers adding locations or machines. Ensure compliance with New York State regulations by carefully reviewing these guidelines.

Cross-Border Taxation

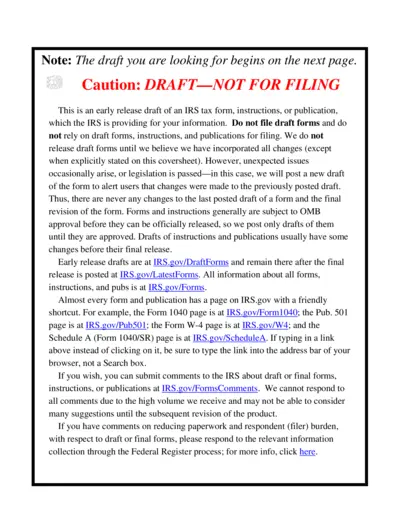

Schedule B-1 Form 1120-S Information and Instructions

The Schedule B-1 (Form 1120-S) is an IRS form used by S corporations to report information on certain shareholders. This early release draft provides essential instructions and details to assist filers in completing the form accurately. It is crucial to use the finalized version after the draft is approved.