Tax Documents

Cross-Border Taxation

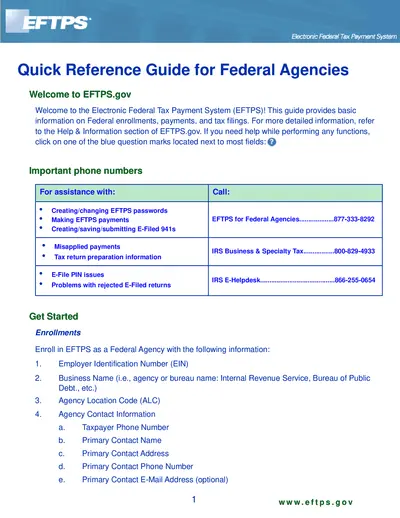

EFTPS Electronic Federal Tax Payment System Guide

This guide provides essential information about the EFTPS, including enrollment, payment methods, and tax filing instructions. Designed for federal agencies, it simplifies the tax payment process. For more thorough guidance, refer to the detailed sections within this document.

Cross-Border Taxation

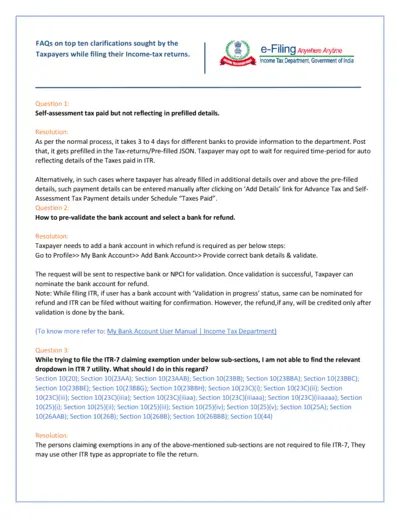

FAQs for Income Tax Return Filing Guidance

This document provides key FAQs for taxpayers about filing their Income Tax Returns. It offers essential clarifications on common issues faced by taxpayers when completing their tax forms. Refer to this guide for effective resolution and compliance.

Cross-Border Taxation

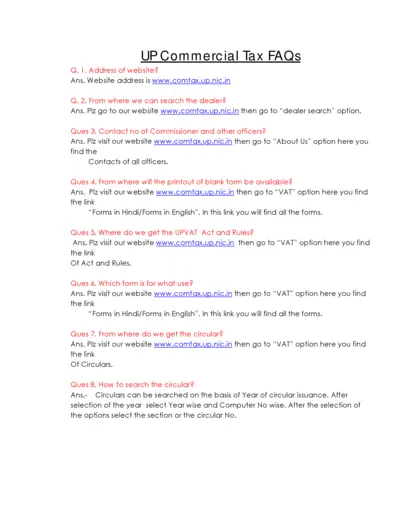

UP Commercial Tax FAQs Guidance

This document provides comprehensive FAQs regarding UP Commercial Tax. Users can find crucial information about dealer search, contact details, and forms. Ideal for businesses and individuals seeking clarity on tax procedures.

Cross-Border Taxation

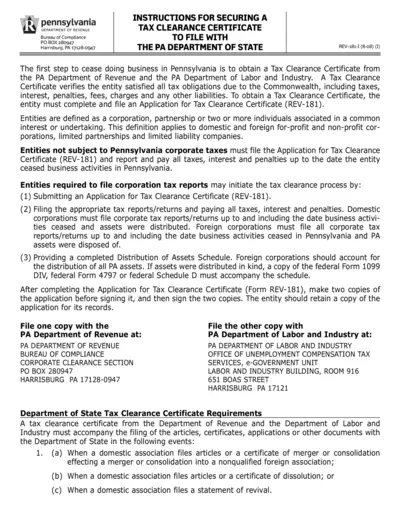

Instructions for Tax Clearance Certificate Pennsylvania

This document provides essential instructions for obtaining a Tax Clearance Certificate in Pennsylvania. It explains the process and requirements for entities ceasing business operations. Ideal for corporations and partnerships needing compliance with state regulations.

Cross-Border Taxation

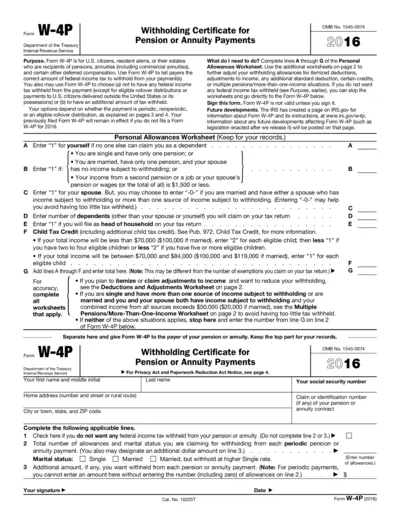

Form W-4P Withholding Certificate for Pension Payments

Form W-4P is the official tax document that allows U.S. citizens and resident aliens to indicate the amount of federal income tax to withhold from their pension or annuity payments. Completing this form accurately ensures proper withholding to meet tax obligations. It's essential for managing your tax liability effectively.

Tax Returns

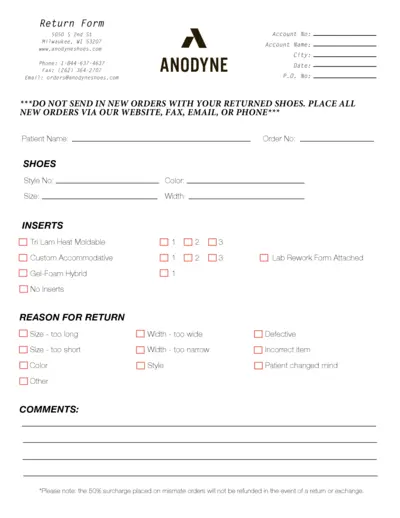

Return Form for Anodyne Shoes

This Return Form allows customers to return or exchange their Anodyne shoes. It includes necessary fields such as patient information and reason for return. Follow the instructions carefully for successful processing.

Cross-Border Taxation

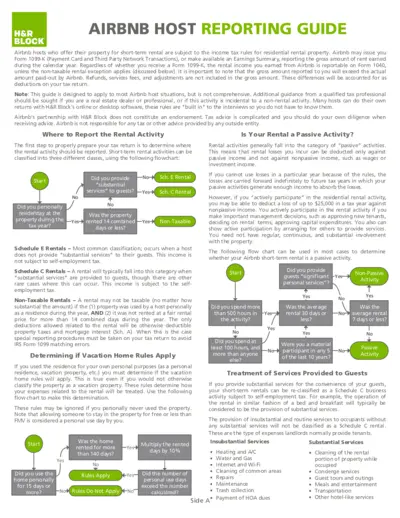

Airbnb Host Income Tax Reporting Guide

This guide provides essential information for Airbnb hosts on income tax reporting for rental properties. Understand tax obligations and filing procedures to ensure compliance. Get insights on common tax forms like 1099-K and how to categorize rental income.

Cross-Border Taxation

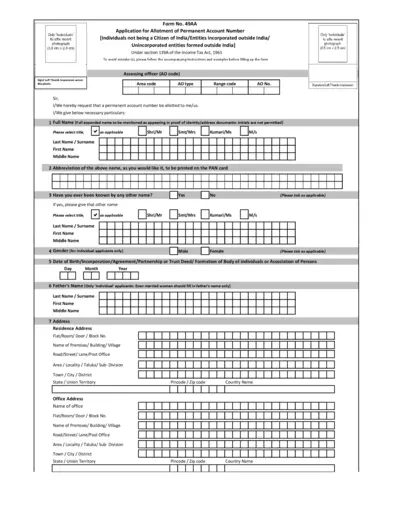

Permanent Account Number Application Instructions

This document provides detailed instructions for individuals applying for a Permanent Account Number (PAN). It outlines the necessary information and steps required for filling out Form No. 49AA. Follow the instructions carefully to ensure accurate submission.

Cross-Border Taxation

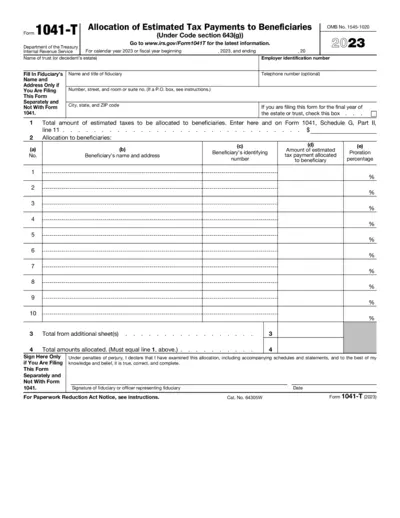

1041-T Allocation of Estimated Tax Payments for 2023

Form 1041-T is used to allocate estimated tax payments to beneficiaries of a trust or decedent's estate. This form is essential for fiduciaries making tax payment elections under code section 643(g). Properly completing this form ensures compliance with IRS regulations.

Payroll Tax

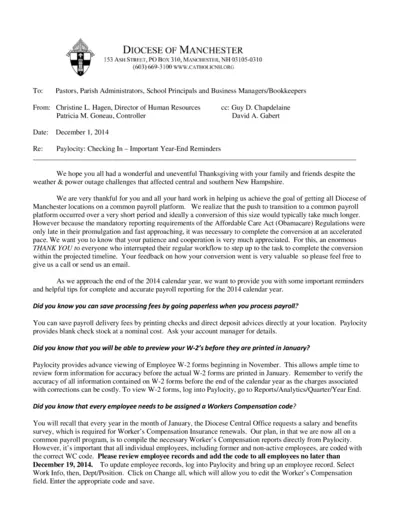

Paylocity: Important Year-End Reminders for Employers

This document provides crucial year-end reminders and tips for payroll reporting. It includes essential instructions for using Paylocity. Ensure your payroll processes are accurate and compliant with regulations.

Payroll Tax

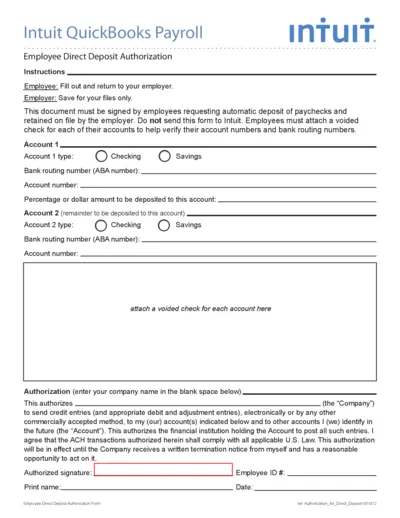

Employee Direct Deposit Authorization Form Instructions

This document provides instructions for employees to set up direct deposit for their paychecks. It includes detailed steps for completing the authorization form. Employers must maintain this form for their records.

Cross-Border Taxation

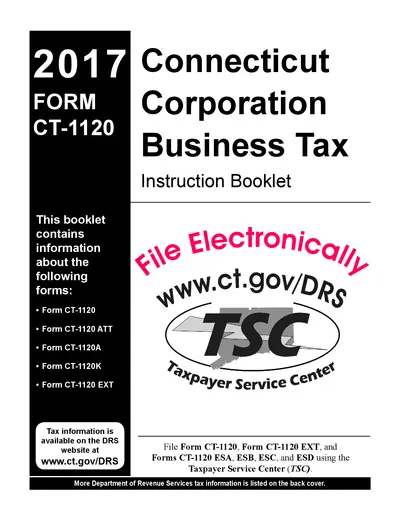

Connecticut Corporation Business Tax Instruction Booklet

This instructional booklet provides detailed information on the Connecticut Corporation Business Tax forms. It includes instructions for forms such as CT-1120, CT-1120 ATT, among others. This resource is essential for corporations to ensure compliance with tax regulations.