Tax Documents

Cross-Border Taxation

Donating a Car to Charity: Tax Deduction Guide

This file provides detailed instructions on how to donate a car to a qualified charity and claim a tax deduction. It outlines the necessary steps and documentation required for a successful donation. Perfect for anyone looking to understand the tax benefits of charitable car donations.

Cross-Border Taxation

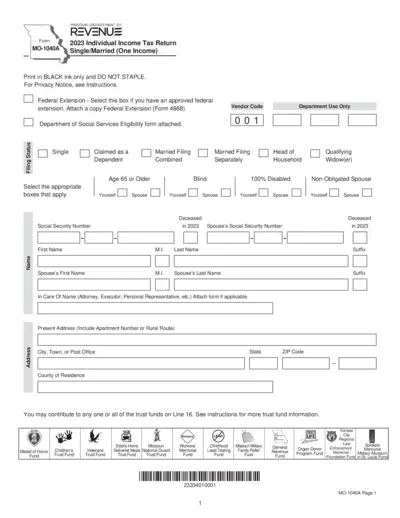

Missouri Individual Income Tax Return MO-1040A 2023

The MO-1040A is a form used for filing individual income tax returns in Missouri. It caters to single and married taxpayers. Complete this form to report your income and claim deductions.

Tax Returns

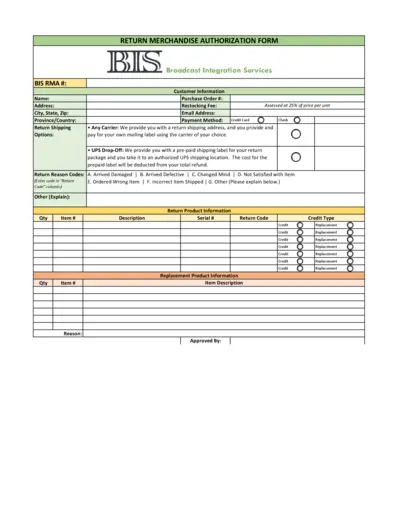

BIS Return Merchandise Authorization Form Guidelines

This document provides detailed information for the BIS Return Merchandise Authorization process. It includes customer information, return shipping options, and instructions for filling out the form. Follow the guidelines to ensure a smooth return process.

Payroll Tax

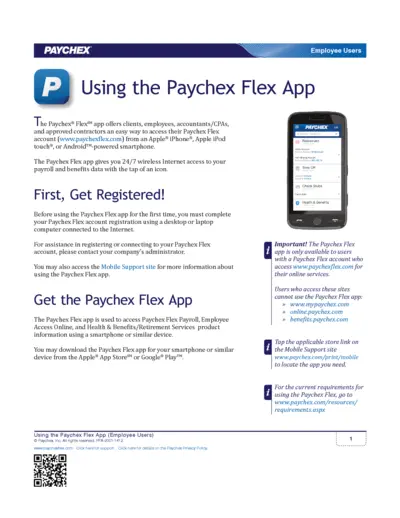

Paychex Flex App User Instructions for Employees

This file provides essential instructions for employees using the Paychex Flex app. It covers registration, app features, and security measures. Follow these guidelines to make the most of your Paychex experience.

Cross-Border Taxation

Minnesota Individual Income Tax Forms and Instructions

This file contains essential forms and instructions for filing individual income tax in Minnesota. It offers guidance on how to complete the forms and important contact information. Whether you are filing electronically or by mail, this document provides all necessary details.

Cross-Border Taxation

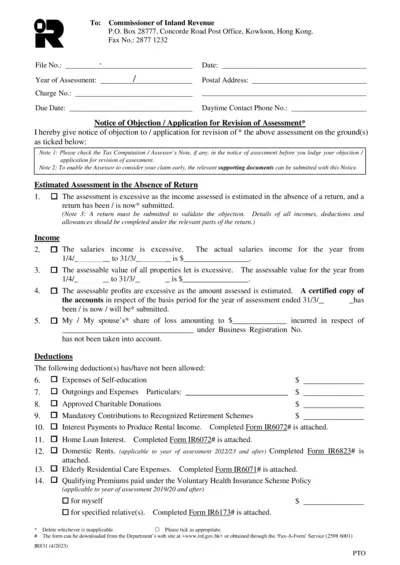

Notice of Objection for Tax Revision HK

This form is used to notify the Inland Revenue Department of objections to tax assessments. It allows individuals to submit relevant evidence and detail reasons for their objections. Ensure you complete it accurately to avoid delays.

Cross-Border Taxation

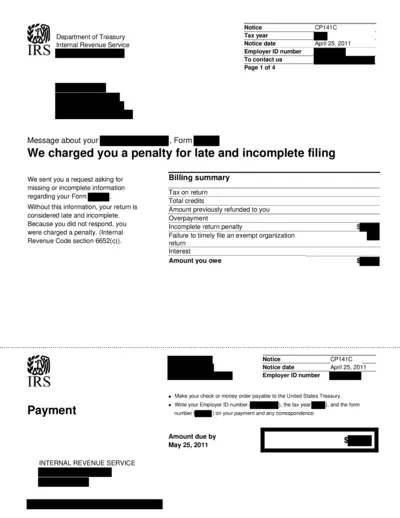

IRS CP141C Notice Penalty for Late Filing Instructions

This file is an IRS CP141C notice regarding penalties for late and incomplete filings. It contains instructions for rectifying filing issues and the consequences of failure to respond. Use this document to understand your obligations and timelines for compliance.

Tax Residency

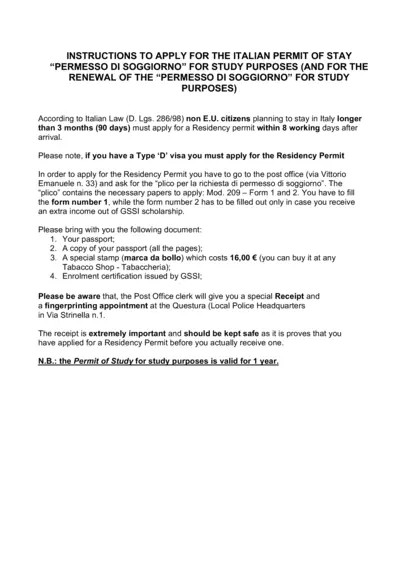

Instructions for Applying Italian Permit of Stay

This document provides step-by-step instructions for non-EU citizens applying for the Italian Permit of Stay for study purposes. It outlines necessary documentation, procedures at the post office, and renewal processes. Understanding this form is crucial for a hassle-free application experience.

Cross-Border Taxation

PAYE EMP201 Employer Monthly Declaration Guide

The PAYE EMP201 is an essential guide for employers looking to understand the new monthly declaration process. This file outlines the updated procedures for submitting tax information to SARS effectively. Follow the instructions to ensure compliance and accuracy in your employer tax submissions.

Cross-Border Taxation

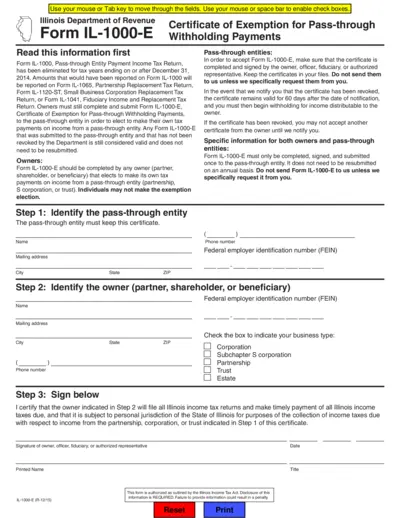

Illinois Form IL-1000-E Certificate of Exemption

The Illinois Form IL-1000-E is a Certificate of Exemption for Pass-through Withholding Payments. It is essential for owners of pass-through entities to submit this form to elect their own tax payments. This form must be completed by owners who want to manage their income tax returns independently.

Cross-Border Taxation

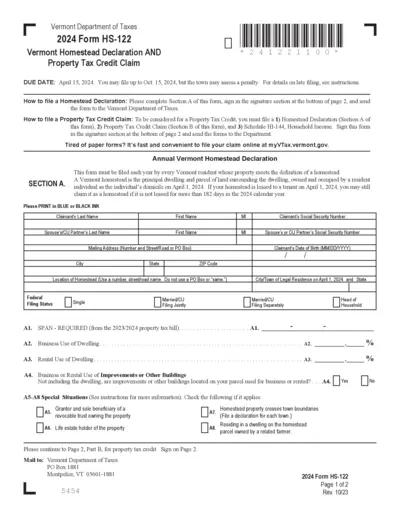

Vermont Homestead Declaration & Property Tax Credit

The Vermont Homestead Declaration and Property Tax Credit Claim form allows residents to declare their property as a homestead. This form must be submitted annually to ensure eligibility for property tax credits. Be sure to follow the instructions carefully to avoid penalties.

Cross-Border Taxation

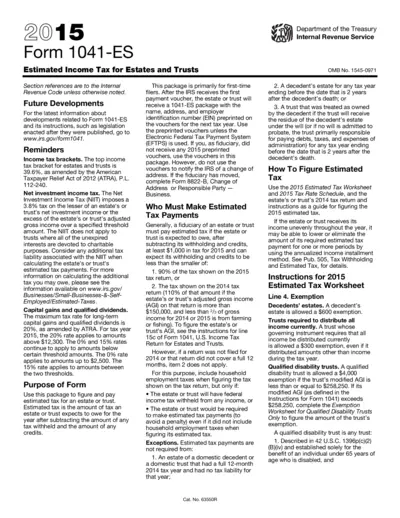

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is used for estimating income tax obligations for estates and trusts. This form assists fiduciaries in calculating and paying estimated taxes owed. It is essential for proper tax management and compliance.