Tax Documents

Cross-Border Taxation

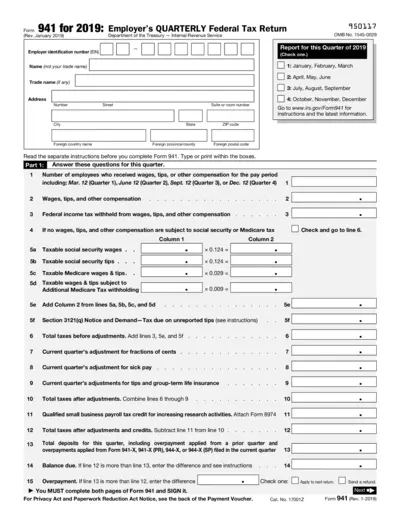

Employer's Quarterly Federal Tax Return Form 941

Form 941 is used by employers to report employee wages and payroll taxes withheld each quarter. It ensures compliance with federal tax obligations. Complete this form accurately to avoid penalties and ensure timely tax payments.

Cross-Border Taxation

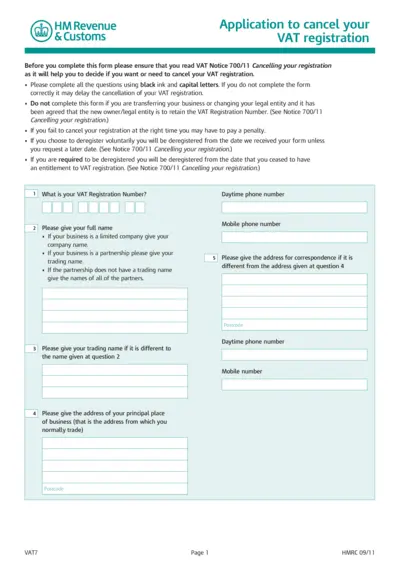

VAT Registration Cancellation Application Form

This document is the HMRC application form for cancelling VAT registration. It provides essential guidance on completing the form accurately. Ensure compliance to avoid potential penalties.

Sales Tax

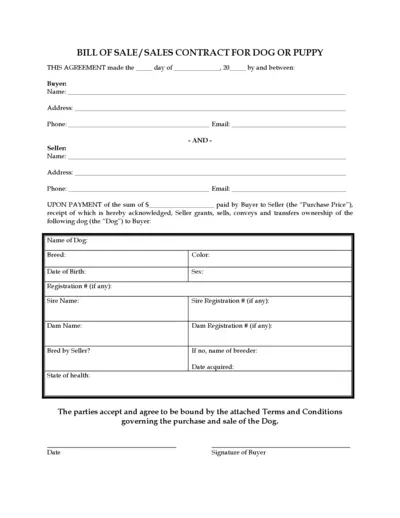

Bill of Sale for Dog or Puppy Sale Agreement

This document is a legally binding agreement regarding the purchase of a dog or puppy. It outlines the responsibilities of the buyer and seller, including payment terms and health guarantees. This contract protects both parties in the transaction.

Cross-Border Taxation

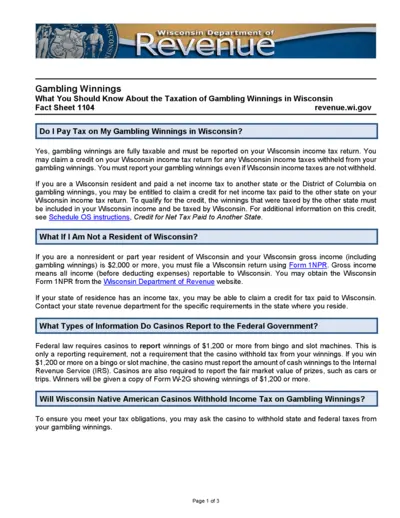

Understanding Gambling Winnings Tax in Wisconsin

This document provides essential information regarding the taxation of gambling winnings in Wisconsin. It outlines what residents and non-residents need to know about reporting winnings and claiming credits. Key regulations and filing instructions are also included to ensure compliance with state tax laws.

Sales Tax

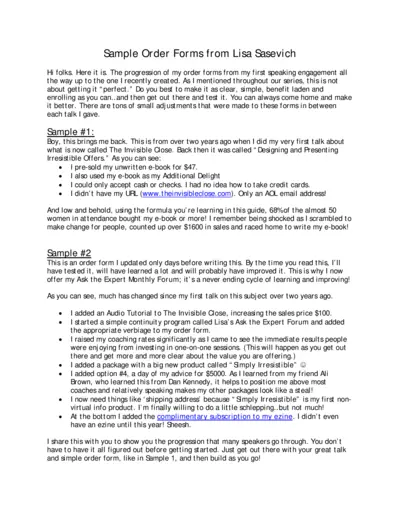

Sample Order Forms from Lisa Sasevich

This file contains sample order forms created by Lisa Sasevich, showcasing the evolution from early to recent order forms. It includes insights on sales techniques, pricing strategies, and the importance of continual improvement. Perfect for speakers and entrepreneurs looking to refine their order forms.

Payroll Tax

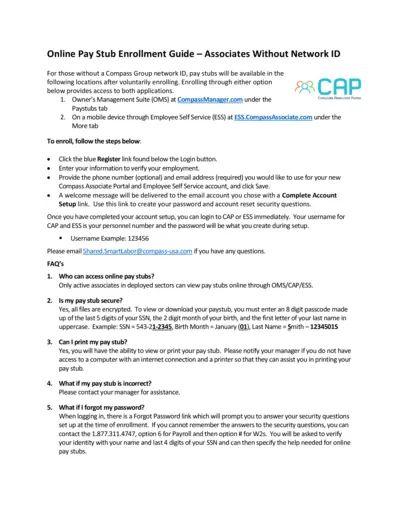

Online Pay Stub Enrollment Guide for Associates

This guide provides instructions for associates without a Compass Group network ID to access their pay stubs online. It covers enrollment steps and FAQs for a seamless experience. Follow these guidelines to ensure you can view and manage your pay stubs effectively.

Sales Tax

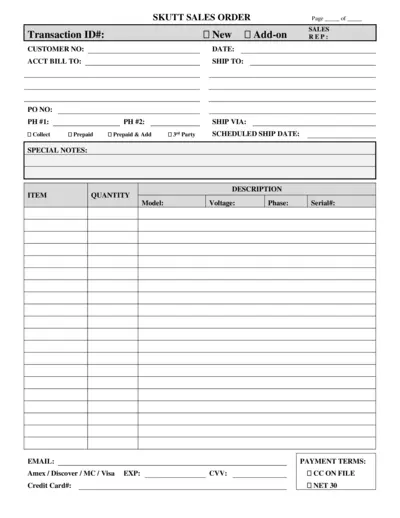

Skutt Sales Order Form for Easy Processing

This Skutt Sales Order File contains essential details for processing orders efficiently. Users can fill out customer information, item details, and payment terms seamlessly. It's designed to streamline the sales order process for both customers and businesses alike.

Tax Residency

Digital Nomad Residence Permit Guide

This guide provides essential information for digital nomads seeking a temporary visa and residence permit in Brazil. It outlines the application process and necessary documentation. Whether you are applying from abroad or within Brazil, this guide will help you navigate your requirements.

Tax Returns

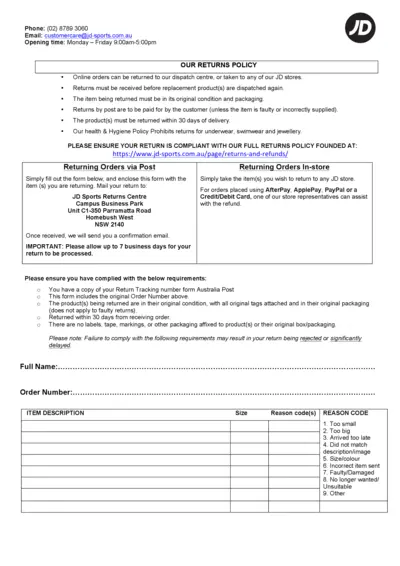

JD Sports Return Instructions and Policy Overview

This document outlines the return policy and instructions for returning items to JD Sports. It provides essential details regarding the return process, including how to return items via post or in-store. Adhering to this guide ensures a smooth and hassle-free return experience.

Cross-Border Taxation

Missouri Employer's Tax Guide

This document provides essential information and instructions for employers starting a business in Missouri. It includes filing requirements, tax payment options, and important deadlines. Utilize this guide to ensure compliance with Missouri tax laws.

Payroll Tax

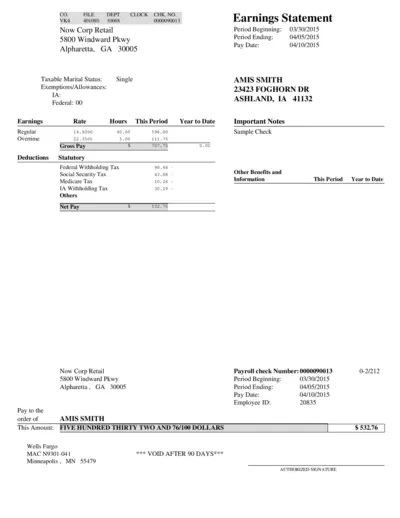

Earnings Statement and Pay Information for Employees

This document is an Earnings Statement that details the pay information for employees. It provides a summary of earnings, deductions, and net pay. Use it to understand your compensation and tax withholdings for the reporting period.

Payroll Tax

Time Sheet Import and RUN Powered by ADP Instructions

This file provides comprehensive guidance on importing time sheets using ADP's payroll application. Users will find detailed instructions on setting up their time sheet import file. It's essential for businesses looking to streamline their payroll processes with ADP.