Tax Documents

Cross-Border Taxation

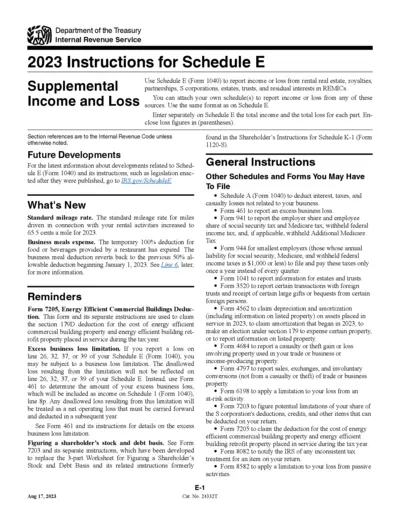

2023 Schedule E Instructions for Income and Loss

This document provides detailed instructions for filling out Schedule E (Form 1040) for 2023. It is essential for reporting income or loss from various sources including rental real estate and partnerships. Make sure to follow the specified guidelines to avoid potential issues with your tax filings.

Payroll Tax

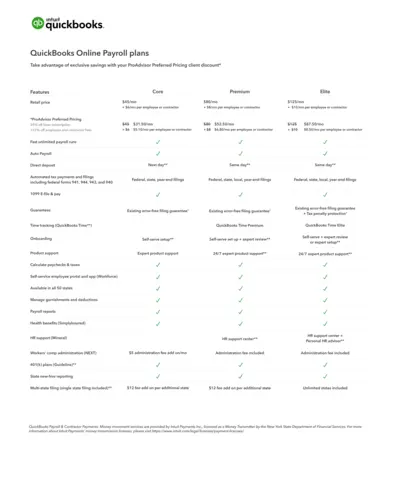

QuickBooks Online Payroll Plans Overview

Explore the features and pricing of QuickBooks Online Payroll plans. Understand how each plan can benefit your business payroll management needs.

Cross-Border Taxation

Maryland 2023 1099 Reporting Instructions

This document provides detailed instructions for Maryland employers on 1099 reporting for tax year 2023. It includes filing requirements, specifications, and updates. Essential for accurate tax reporting in Maryland.

Cross-Border Taxation

1040EZ Tax Filing Instructions and Guidelines

This file provides comprehensive instructions for preparing and filing your 1040EZ tax form. It includes filing requirements and helpful tips to ensure accuracy. Get your taxes done quickly and efficiently with this guide.

Tax Returns

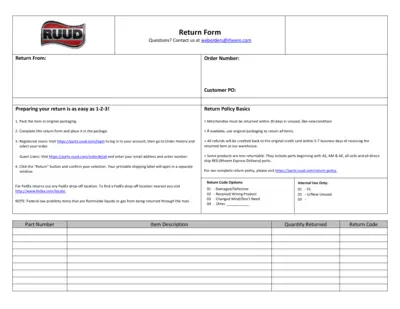

RUUD Return Form Instructions and Guidelines

The RUUD Return Form simplifies the merchandise return process. Users can easily follow the step-by-step instructions for returning items. This form is essential for both registered and guest users to ensure a smooth return experience.

Tax Returns

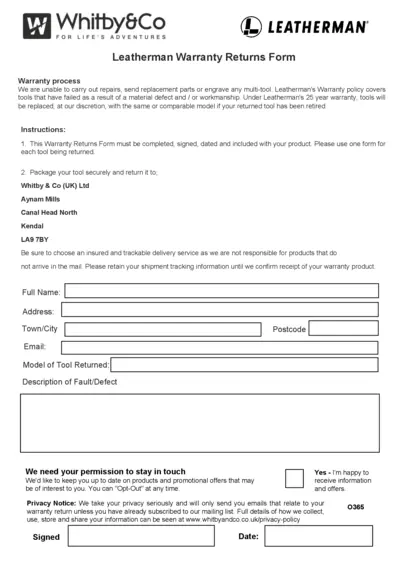

Leatherman Warranty Returns Form Instructions

This document provides detailed instructions for returning your Leatherman multi-tool under warranty. Ensure that you follow the specified steps for a smooth warranty claim process. Fill out the warranty return form accurately to facilitate efficient handling of your claim.

Cross-Border Taxation

California Sales Tax Guide for Veterinarians

This publication serves as a comprehensive guide to understanding California's Sales and Use Tax Law for veterinary practices. It is essential for veterinarians and related businesses needing clarity on tax regulations. Contact our Customer Service for further assistance.

Cross-Border Taxation

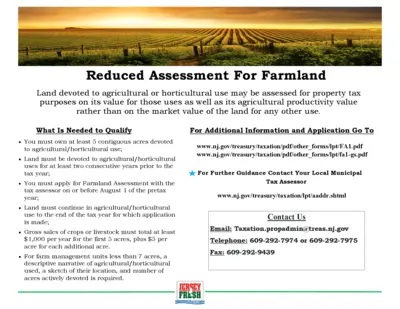

Reduced Property Tax Assessment for Farmland

This file provides detailed information on reduced property tax assessments for farmland and woodland management. It outlines qualifications, application procedures, and helpful resources. Learn how to profit from agricultural use and secure tax benefits.

Tax Returns

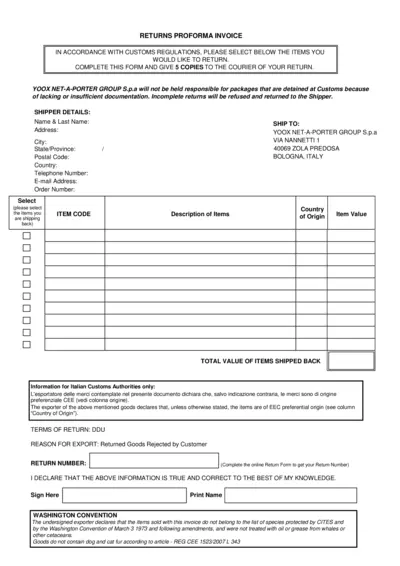

Returns Proforma Invoice for Customs Compliance

This Returns Proforma Invoice is designed for customers returning items through customs. It outlines the necessary information required for return shipping. Ensure to fill it out completely to avoid processing issues.

Cross-Border Taxation

KPMG Tax Flash Report on Form No. 16

This document provides essential information regarding the generation and download of Part B of Form No. 16 through the TRACES portal. It outlines the correct procedures for deductors to report tax deductions from April 2018 onwards. Key highlights include the timely issuance of TDS certificates to employees.

Sales Tax

Closing the Sale: Strategies and Techniques

This document covers essential strategies for effectively closing sales. It provides insights on customer satisfaction and retention techniques. Ideal for marketing and sales professionals looking to enhance their skills.

Cross-Border Taxation

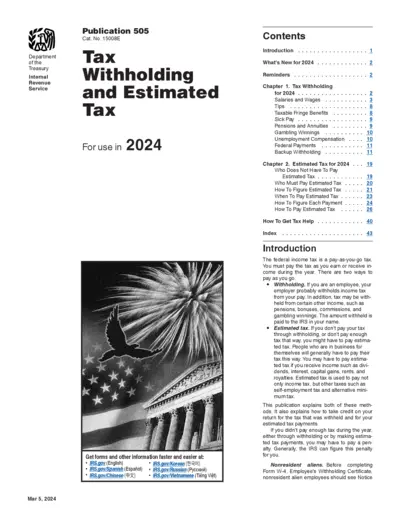

Tax Withholding and Estimated Tax Guidelines 2024

This file provides essential information on tax withholding and estimated tax for the year 2024. It outlines the methods of payment, important updates, and necessary forms. Users will find guidance on how to correctly complete tax-related documentation and avoid penalties.