Edit, Download, and Sign the Guidelines for VAT Registration Application

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this application, gather all necessary documents and complete Form 101. Ensure all provided information is accurate and complete, including personal details and business information. Submit the completed form along with required supporting documents to the appropriate registering authority.

How to fill out the Guidelines for VAT Registration Application?

1

Gather necessary documents.

2

Complete Form 101 accurately.

3

Submit the form to the registering authority.

4

Provide required supporting documents.

5

Await approval or further instructions.

Who needs the Guidelines for VAT Registration Application?

1

Individual dealers exceeding Rs. 5 Lakhs turnover - to comply with VAT registration requirements.

2

Partnership firms - to ensure all partners are registered under VAT.

3

Private limited companies - to obtain necessary tax identification.

4

Hindu Undivided Families - for legal compliance in business operations.

5

State or Central Government organizations - for necessary tax documentation.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Guidelines for VAT Registration Application along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Guidelines for VAT Registration Application online.

Editing this PDF on PrintFriendly is simple and efficient. You can modify text, add or remove sections, and customize the content to fit your requirements. Experience seamless editing with our user-friendly tools.

Add your legally-binding signature.

Sign your PDF effortlessly on PrintFriendly. Utilize our intuitive signing feature, which allows you to add your signature with just a few clicks. Ensure your document is finalized and ready for submission.

Share your form instantly.

Easily share your PDF on PrintFriendly with others. Utilize our share feature to distribute your document via email or social media. Collaborate effectively by providing access to your files.

How do I edit the Guidelines for VAT Registration Application online?

Editing this PDF on PrintFriendly is simple and efficient. You can modify text, add or remove sections, and customize the content to fit your requirements. Experience seamless editing with our user-friendly tools.

1

Open the PDF in PrintFriendly.

2

Select the text or sections you wish to edit.

3

Make your changes directly in the document.

4

Review your modifications for accuracy.

5

Download the edited PDF to save your changes.

What are the instructions for submitting this form?

To submit the VAT registration form, please complete Form 101 along with all supporting documents. You can submit your application online through the registration authority's website or send it via mail to the appropriate address. Ensure all information is accurate and complete to avoid delays in processing.

What are the important dates for this form in 2024 and 2025?

Important dates for VAT registration in 2024 and 2025 will depend on specific deadlines set by the registering authority. Keep November 30, 2024, for the fiscal year end in mind. Ensure timely submission of your application to avoid penalties.

What is the purpose of this form?

The purpose of this form is to formalize the registration process for dealers under the VAT Act. It establishes legal compliance to pay Value Added Tax based on sales and purchases. Completing this form accurately is crucial for obtaining a Tax Identification Number (TIN) and avoiding complications.

Tell me about this form and its components and fields line-by-line.

- 1. Dealer Information: Details about the dealer, including business name and address.

- 2. Ownership Proof: Documentation proving ownership of the business location.

- 3. Personal Identification: Passport, driving license, or election card for identity verification.

- 4. Supporting Documents: Additional documents like tax bills for business verification.

What happens if I fail to submit this form?

Failing to submit this form may result in legal penalties or fines. Dealers would be considered non-compliant with VAT regulations.

- Legal Penalties: Failure to register can lead to fines imposed by tax authorities.

- Loss of Business Legitimacy: Unregistered transactions may affect business operations.

- Increased Scrutiny: Non-compliance can trigger audits and investigations from tax authorities.

How do I know when to use this form?

- 1. Starting a New Business: Essential for new businesses exceeding the turnover limits.

- 2. Expanding Current Business: Existing dealers must register if their turnover exceeds limits.

- 3. Partnership Formation: New partnerships need this form for official registration under VAT.

- 4. Corporate Establishment: Corporations must register to legally operate and pay taxes.

- 5. Transitioning Business Models: Businesses changing their operating structure must complete this registration.

Frequently Asked Questions

How do I begin to fill out the VAT registration form?

Start by accessing the PDF form on PrintFriendly and gathering all required documents.

Can I edit the VAT registration PDF?

Yes, PrintFriendly allows you to edit PDF documents easily.

How do I submit the registration form?

You can submit the form online or in person as per the guidelines provided.

What supporting documents are required?

A list of necessary documents is included in the guidelines.

Is there a deadline for submission?

Applications should be submitted within thirty days of meeting turnover thresholds.

How will I know if my application is approved?

The registering authority will notify you of your application's status.

What if my application is rejected?

You will receive a notification detailing the reasons for rejection.

Can I track my application status online?

Yes, you can view the status of your application through the registration authority's website.

What to do if I missed the submission deadline?

You may still submit your application, but it is advisable to contact the registration authority.

How long does it take to receive my TIN?

TIN issuance can occur within 24 hours after verification of documents.

Related Documents - VAT Registration Guidelines

All India Survey on Higher Education Data Capture Format 2019-2020

This file is the All India Survey on Higher Education for the year 2019-2020. It contains data capture formats for colleges and institutions affiliated by the university. The information includes college details, contact information, and geographical referencing.

Soquel High School Cheerleader Registration Packet 2024-2025

This file contains important information for students considering applying for the cheerleader position at Soquel High School. It includes dates, costs, and instructions for tryouts and participation. Make sure to review and get parental approval before proceeding.

Effective Summer Learning Program Planning Toolkit

This file offers guidance and evidence-based tools for delivering effective summer learning programs. It covers planning, recruitment, staffing, and more. The toolkit is designed for education leaders and program managers.

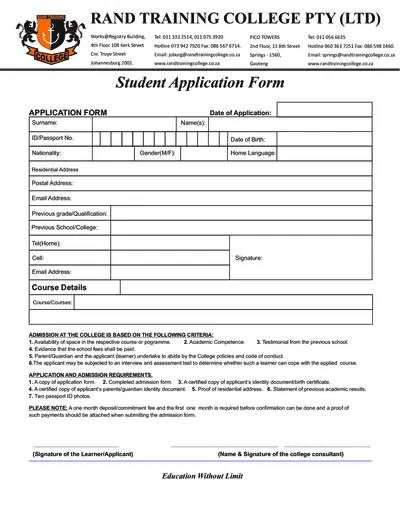

Student Application Form for Rand Training College

This file is a student application form for Rand Training College, including admission requirements and course details. It requires personal information, previous academic records, and other supporting documents. Complete the form to apply for courses offered by the college.

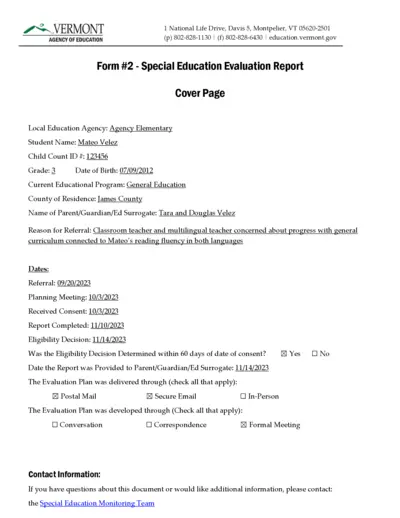

Special Education Evaluation Report - Vermont Agency

This file contains the Special Education Evaluation Report for a student named Mateo Velez. It includes details about the evaluation plan, team members involved, and assessment procedures used. The document is designed to determine the student's eligibility for special education services.

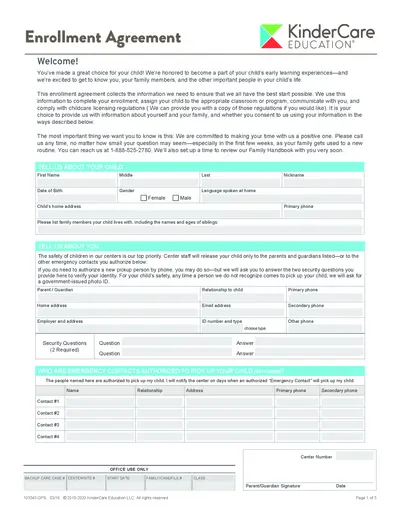

KinderCare Education Enrollment Agreement Form

This file is the enrollment agreement for KinderCare Education. It collects crucial information for your child's enrollment, classroom/program assignment, and compliance with childcare licensing regulations. Make sure to fill it out accurately to ensure a smooth enrollment process.

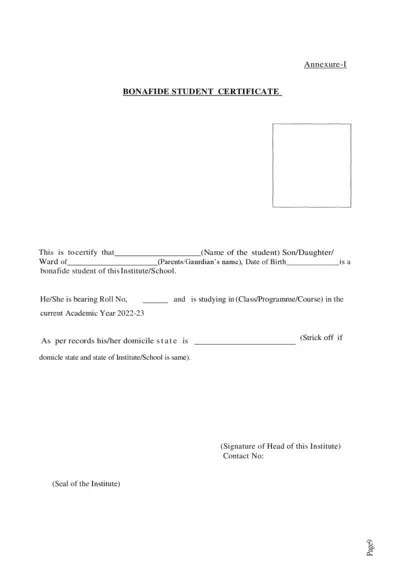

Bonafide Student Certificate & Scholarship Consent Forms

This file contains the Bonafide Student Certificate template, consent form for the use of Aadhaar/EID numbers in a state scholarship application, and an institution verification form for scholarship applications. It is intended for students applying for state scholarships and institutions verifying student information.

NIOS Prospectus 2011-12 for Gulf, Kuwait, Qatar

This file provides details and instructions for admission to the National Institute of Open Schooling (NIOS) for secondary and senior secondary courses in Gulf, Kuwait, and Qatar. It includes information on the admission process, available subjects, and other essential details. It is useful for prospective students seeking flexible and accessible education options.

Undergraduate Bursary and Loan Opportunities for 2024 at University of Cape Town

This file provides information about the bursary and loan opportunities available for undergraduate students at the University of Cape Town for the academic year 2024. It includes details about financial aid, scholarships, and bursaries offered by the university and external organizations. Students can find instructions on how to apply and important contact information in this comprehensive guide.

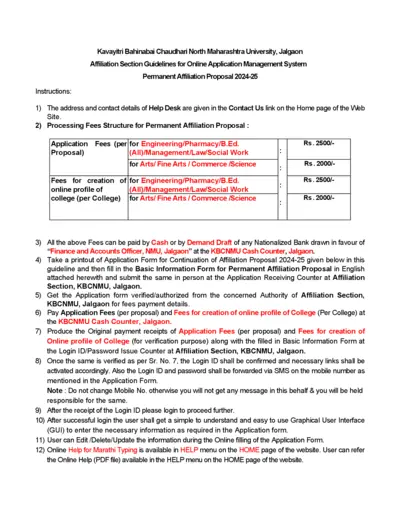

KBCNMU Permanent Affiliation Proposal 2024-25 Guidelines

This file provides detailed guidelines for filling out the Permanent Affiliation Proposal for 2024-25 for Kavayitri Bahinabai Chaudhari North Maharashtra University. It includes instructions for processing fees, submission process, and necessary documents. The document is essential for institutions seeking permanent affiliation with the university.

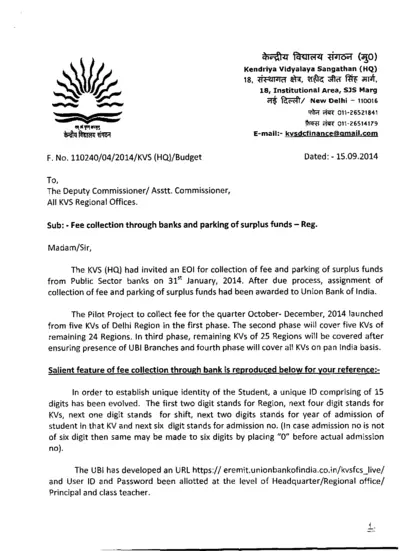

KVS Fee Collection and Surplus Funds Management 2014

This file contains information about the fee collection process through banks and the management of surplus funds for Kendriya Vidyalaya Sangathan (KVS). It details the pilot project, phases of implementation, and instructions for schools. It also includes guidelines for filling out student information online and tripartite accounts.

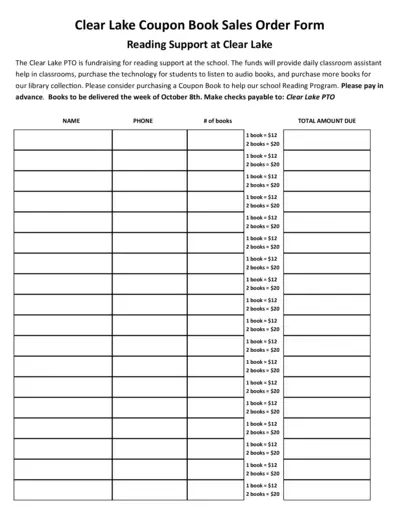

Clear Lake PTO Reading Support Coupon Book Sales Order Form

This form is used for purchasing coupon books to support reading programs at Clear Lake. The funds will help provide classroom assistance, technology for audiobooks, and more books for the library. Please fill out the form to help support the school.