Understanding Edward Jones 2023 Form 5498

This document provides essential information regarding Form 5498 from Edward Jones. It details contributions, rollovers, and account values for your self-directed retirement account. Utilized for informational purposes, it is key for maintaining accurate records for tax filings.

Edit, Download, and Sign the Understanding Edward Jones 2023 Form 5498

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out Form 5498, start by gathering all relevant contribution and rollover information for the year. Make sure to report all applicable contributions and their respective amounts accurately. Once completed, keep a copy for your records.

How to fill out the Understanding Edward Jones 2023 Form 5498?

1

Gather all necessary contribution and rollover information.

2

Fill in the total contributions for the reporting period.

3

Report any recharacterized contributions made during the year.

4

Ensure to indicate any fair market value (FMV) of the account as of December 31.

5

Retain a copy of the completed form for your records.

Who needs the Understanding Edward Jones 2023 Form 5498?

1

Individuals contributing to a traditional or Roth IRA need Form 5498 to report their contributions for tax purposes.

2

Tax professionals require this form to assist clients with accurate tax filings.

3

Retirement account holders must retain this form for evidence of contributions and rollovers.

4

Financial advisors utilize this form to review client retirement contributions and provide relevant advice.

5

Businesses facilitating SEP and SIMPLE IRAs must provide this form to their clients for IRS reporting.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Understanding Edward Jones 2023 Form 5498 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Understanding Edward Jones 2023 Form 5498 online.

With PrintFriendly's PDF editor, editing your Form 5498 is simple and efficient. You can easily add or modify information as required, ensuring your form is accurate. Make your edits directly in the PDF, and then download the revised document.

Add your legally-binding signature.

Signing your PDF is a breeze with PrintFriendly's new feature. You can add your signature directly onto the document, ensuring authenticity. After signing, simply save and share your signed Form 5498.

Share your form instantly.

Sharing your PDF is straightforward with PrintFriendly. You can quickly generate a shareable link after editing your document. This allows others to access your Form 5498 easily and conveniently.

How do I edit the Understanding Edward Jones 2023 Form 5498 online?

With PrintFriendly's PDF editor, editing your Form 5498 is simple and efficient. You can easily add or modify information as required, ensuring your form is accurate. Make your edits directly in the PDF, and then download the revised document.

1

Open the PDF file in PrintFriendly's editor.

2

Navigate to the fields you need to change and enter your information.

3

Utilize the text formatting options to adjust your entries as necessary.

4

After editing, check for accuracy and make any additional adjustments.

5

Download the edited PDF to your device.

What are the instructions for submitting this form?

To submit Form 5498, ensure that you have accurately filled out all relevant sections of the form. You can submit it electronically through the IRS e-file system or via standard mail to the address specified by the IRS for tax form submissions. If unsure about the submission process, consult a tax professional for personalized guidance.

What are the important dates for this form in 2024 and 2025?

Important dates for Form 5498 include the deadline for issuance on May 31, 2024, for the 2023 tax year. Additionally, contributions made up until April 15, 2024, are included in this reporting. Ensure to retain this form for your records after its receipt.

What is the purpose of this form?

The primary purpose of Form 5498 is to report contributions, rollovers, conversions, and the fair market value of your Individual Retirement Accounts (IRAs). This form notifies both taxpayers and the IRS of the contributions made to traditional and Roth IRAs for the tax year. By having a consolidated record, individuals can better manage their retirement savings and ensure compliance with tax regulations.

Tell me about this form and its components and fields line-by-line.

- 1. Box 1: Reports total contributions made to a traditional IRA.

- 2. Box 2: Reports rollovers deposited into the IRA.

- 3. Box 3: Details the fair market value of converted assets.

- 4. Box 4: Shows the total amount of recharacterized contributions.

- 5. Box 5: Reports the fair market value of the account.

- 6. Box 6: Displays amounts related to life insurance on endowment contracts.

- 7. Box 7: Identifies the type of IRA reported.

- 8. Box 8: Reports SEP IRA contributions.

- 9. Box 9: Reports SIMPLE IRA contributions.

- 10. Box 10: Details Roth IRA contributions.

- 11. Box 11: Indicates if a required minimum distribution is necessary.

- 12. Box 12a: Reports the deadline for RMD distributions.

- 13. Box 12b: Reports the amount of the required minimum distribution.

- 14. Box 13a: Shows late rollover contributions.

- 15. Box 13b: Indicates the year credited for postponed contributions.

- 16. Box 13c: Reports reason codes for postponed contributions.

- 17. Box 14a: Shows repayments of qualified reservist distributions.

- 18. Box 14b: Details codes for different types of repayments.

- 19. Box 15a: Reports FMV of specified investments in the IRA.

- 20. Box 15b: Codes indicating types of investments held in the IRA.

What happens if I fail to submit this form?

Failure to submit Form 5498 will not lead to immediate penalties, but it can result in incomplete records for the IRS. This might complicate your tax situation and affect your tax credits or deductions. Keeping the form is crucial for future reference, especially during tax season.

- Missing Contribution Records: You could have incomplete records about your IRA contributions affecting your tax filings.

- IRS Compliance Issues: Failure to provide necessary information may lead to inquiries or audits from the IRS.

- Inaccurate Tax Reporting: You risk inaccurate reporting of contributions, leading to potential tax liabilities.

How do I know when to use this form?

- 1. Contributions Reporting: To report all contributions made to your IRA by the deadline.

- 2. Rollover Reporting: To track rollovers from one IRA to another.

- 3. Tax Filing Reference: To use as a reference when filing your tax return.

Frequently Asked Questions

What is Form 5498?

Form 5498 is used to report contributions, rollovers, and the fair market value of your IRA accounts.

Do I need to submit Form 5498 with my tax return?

No, Form 5498 is for informational purposes only and does not need to be submitted with your tax return.

When will I receive Form 5498 for 2023?

Form 5498 for 2023 will be provided by May 31, 2024.

How do I fill out Form 5498?

Gather all contribution information, fill in the required fields, and retain a copy for your records.

What if I made an excess contribution?

All contributions, including excess amounts, must be reported on Form 5498.

How can I edit my Form 5498?

You can edit your Form 5498 using PrintFriendly's PDF editor after downloading it.

Can I share my completed Form 5498?

Yes, you can easily generate a shareable link to your edited PDF.

Is there a deadline for Form 5498?

Form 5498 must be completed accurately by the time of your tax filing deadline.

Can I obtain guidance on how to fill out this form?

Yes, consult a tax professional for assistance with filling out Form 5498.

What happens if I fail to file Form 5498?

Failure to file does not incur penalties but may result in incomplete tax documentation.

Related Documents - Form 5498 Edward Jones 2023

All India Survey on Higher Education Data Capture Format 2019-2020

This file is the All India Survey on Higher Education for the year 2019-2020. It contains data capture formats for colleges and institutions affiliated by the university. The information includes college details, contact information, and geographical referencing.

Soquel High School Cheerleader Registration Packet 2024-2025

This file contains important information for students considering applying for the cheerleader position at Soquel High School. It includes dates, costs, and instructions for tryouts and participation. Make sure to review and get parental approval before proceeding.

Effective Summer Learning Program Planning Toolkit

This file offers guidance and evidence-based tools for delivering effective summer learning programs. It covers planning, recruitment, staffing, and more. The toolkit is designed for education leaders and program managers.

Student Application Form for Rand Training College

This file is a student application form for Rand Training College, including admission requirements and course details. It requires personal information, previous academic records, and other supporting documents. Complete the form to apply for courses offered by the college.

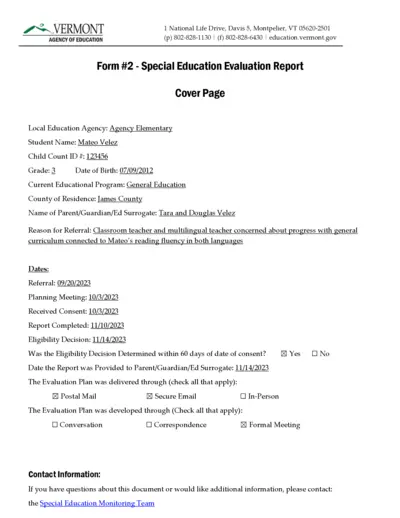

Special Education Evaluation Report - Vermont Agency

This file contains the Special Education Evaluation Report for a student named Mateo Velez. It includes details about the evaluation plan, team members involved, and assessment procedures used. The document is designed to determine the student's eligibility for special education services.

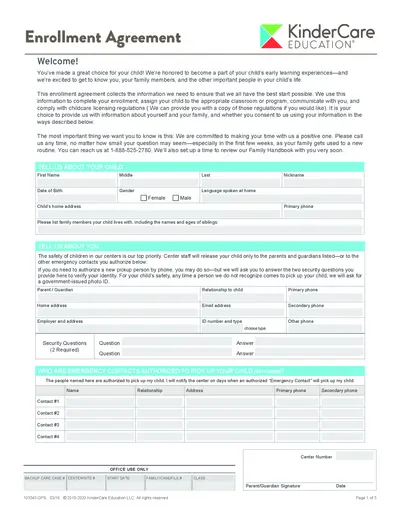

KinderCare Education Enrollment Agreement Form

This file is the enrollment agreement for KinderCare Education. It collects crucial information for your child's enrollment, classroom/program assignment, and compliance with childcare licensing regulations. Make sure to fill it out accurately to ensure a smooth enrollment process.

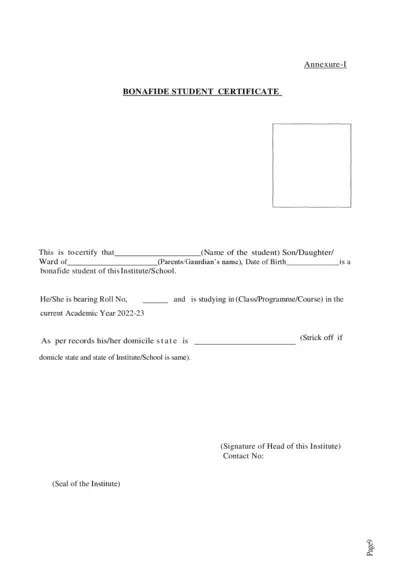

Bonafide Student Certificate & Scholarship Consent Forms

This file contains the Bonafide Student Certificate template, consent form for the use of Aadhaar/EID numbers in a state scholarship application, and an institution verification form for scholarship applications. It is intended for students applying for state scholarships and institutions verifying student information.

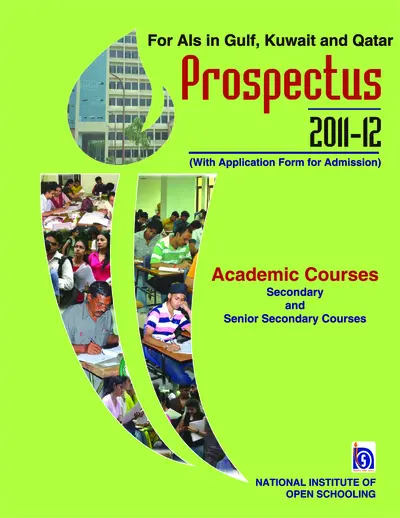

NIOS Prospectus 2011-12 for Gulf, Kuwait, Qatar

This file provides details and instructions for admission to the National Institute of Open Schooling (NIOS) for secondary and senior secondary courses in Gulf, Kuwait, and Qatar. It includes information on the admission process, available subjects, and other essential details. It is useful for prospective students seeking flexible and accessible education options.

Undergraduate Bursary and Loan Opportunities for 2024 at University of Cape Town

This file provides information about the bursary and loan opportunities available for undergraduate students at the University of Cape Town for the academic year 2024. It includes details about financial aid, scholarships, and bursaries offered by the university and external organizations. Students can find instructions on how to apply and important contact information in this comprehensive guide.

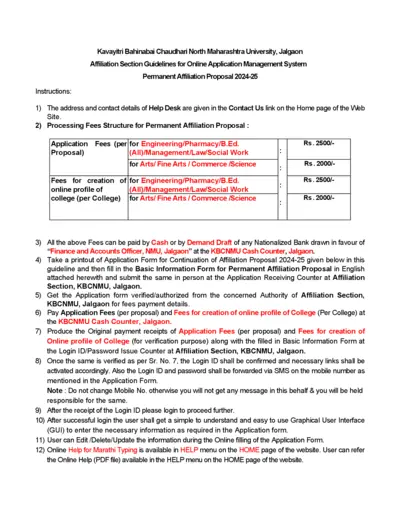

KBCNMU Permanent Affiliation Proposal 2024-25 Guidelines

This file provides detailed guidelines for filling out the Permanent Affiliation Proposal for 2024-25 for Kavayitri Bahinabai Chaudhari North Maharashtra University. It includes instructions for processing fees, submission process, and necessary documents. The document is essential for institutions seeking permanent affiliation with the university.

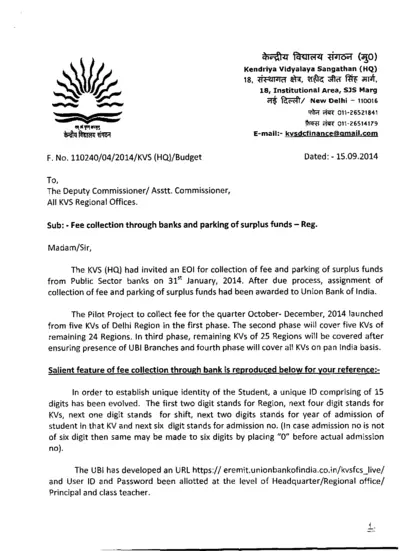

KVS Fee Collection and Surplus Funds Management 2014

This file contains information about the fee collection process through banks and the management of surplus funds for Kendriya Vidyalaya Sangathan (KVS). It details the pilot project, phases of implementation, and instructions for schools. It also includes guidelines for filling out student information online and tripartite accounts.

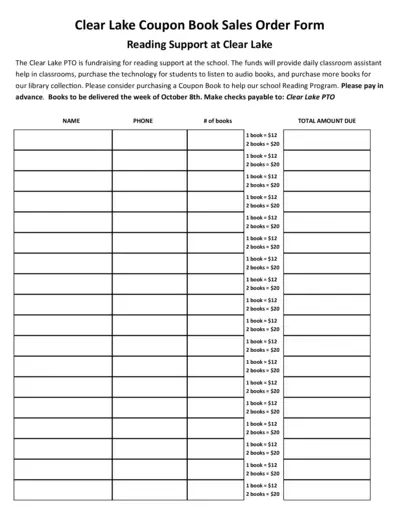

Clear Lake PTO Reading Support Coupon Book Sales Order Form

This form is used for purchasing coupon books to support reading programs at Clear Lake. The funds will help provide classroom assistance, technology for audiobooks, and more books for the library. Please fill out the form to help support the school.